Summary

After a strong beginning of the week, the crypto market has taken a turn for the worse, with BCH, AVAX, and DOGE all seeing significant decreases in price. While BCH continues to hold above $100, both AVAX and DOGE have fallen below key support levels, with DOGE sitting at just over $0.06. The overall market trend remains down, though there are some signs that the worst may be over for the short term.

XRP

XRP is currently trading at $0.538, down 2.73% in the last 24 hours. XRP has been in a steady decline since mid-March and is currently down over 20% from its high of $0.67 reached just a few weeks ago. The recent sell-off has brought XRP below its 200-day moving average (MA), a key support level, though it has so far held above $0.50.

The MACD (moving average convergence divergence) indicator is currently in a bullish configuration, though with a downward trend. The Relative Strength Index (RSI) is currently 51.5 in neutral territory.

XRP is currently in a short-term uptrend, though both the medium- and long-term trends are down. The Average Directional Index (ADX) is currently at 18.5, indicating a weak trend.

ALGO

Algo is currently trading at $0.125, down 1.18% in the last 24 hours. Algo has followed a similar trend to other major altcoins in recent weeks, falling sharply from its all-time high of $0.19 reached in early March. The sell-off has brought Algo below its 200-day MA, though it has so far held above $0.12, a key support level.

The MACD is currently in a bearish configuration, though with a downward trend. The RSI is currently at 69.6, indicating an overbought condition.

Algo is currently in a short-term downtrend, though both the medium- and long-term trends are down. The ADX is currently at 40.1, indicating a strong trend.

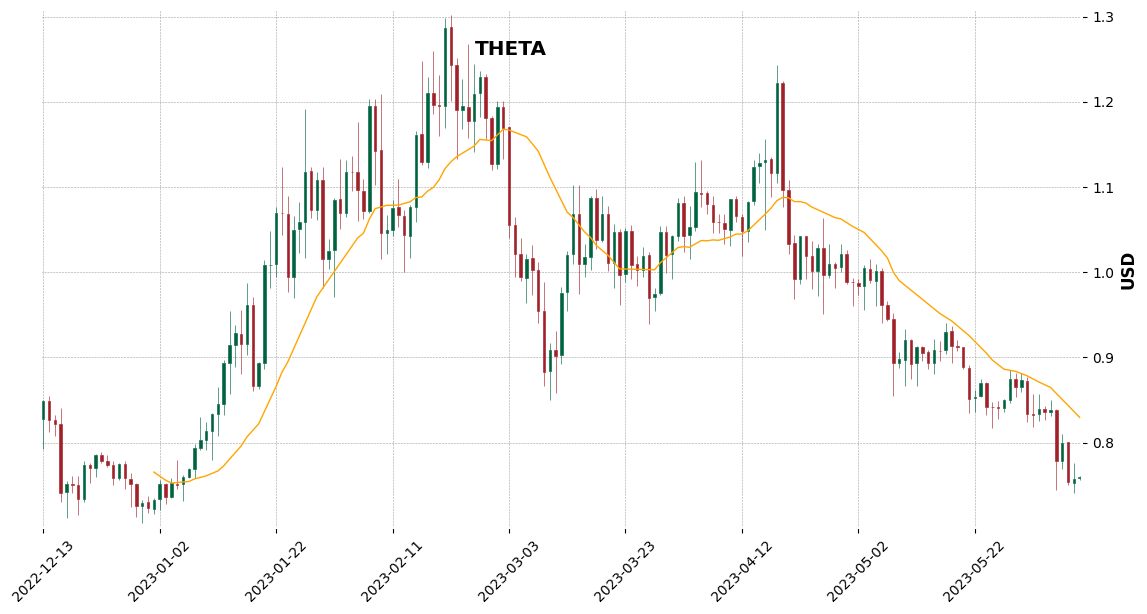

THETA

Theta is currently trading at $0.750, down 0.95% in the last 24 hours. Theta has followed a similar trend to other major altcoins in recent weeks, falling sharply from its all-time high of $0.87 reached in early March. The sell-off has brought Theta below its 200-day MA, though it has so far held above $0.75, a key support level.

The MACD is currently in a bearish configuration, though with a downward trend. The RSI is currently at 69.3, indicating an overbought condition.

Theta is currently in a short-term downtrend, though both the medium- and long-term trends are down. The ADX is currently at 40.6, indicating a strong trend.

ATOM

Atom is currently trading at $0.129, up 2.84% in the last 24 hours. Atom has followed a similar trend to other major altcoins in recent weeks, falling sharply from its all-time high of $0.16 reached in early March. The sell-off has brought Atom below its 200-day MA, though it has so far held above $0.13, a key support level.

The MACD is currently in a bullish configuration, though with a downward trend. The RSI is currently at 69.6, indicating an overbought condition.

Atom is currently in a short-term uptrend, though both the medium- and long-term trends are down. The ADX is currently at 18.5, indicating a weak trend.