Welcome back to another in-depth analysis of crypto tokens we are watching this week. With the upcoming ETF decision, this week will be decisive for the entire crypto industry. However, we tried to exclude this event from our analysis as much as possible since it is impossible to thoroughly predict the decisions and their impact.

Nevertheless, we again put together three tokens worth watching due to their technical indicators. Let’s dive right into it!

The text is an extract of our weekly publication, “The Bold 10.” — Sign Up here and receive the entire publication every week right into your inbox!

Tokens To Watch This Week #1 — Bitcoin (BTC)

In this week’s edition of Bold 10, Bitcoin (BTC) takes center stage, buoyed by a myriad of market indicators and its unchallenged position as the pioneer cryptocurrency. With the upcoming ETF decision casting both shadows and light, let’s explore why BTC remains a focal point in this week’s analysis.

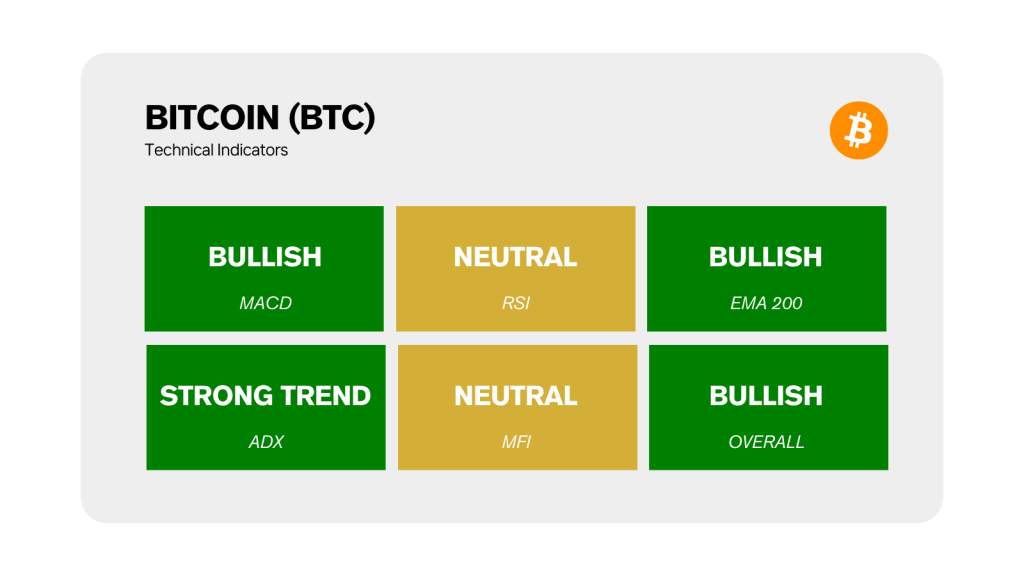

BTC’s Market Indicators: Balancing Act Amidst Potential ETF Impact

Bitcoin’s market indicators present a narrative of resilience coupled with anticipation. The RSI maintains a neutral stance, suggesting a balanced market that is neither overbought nor oversold. The bullish MACD signals potential upward price movement, resonating with Bitcoin’s recent 24-hour increase of 6.45%.

Bitcoin’s price action is particularly pivotal this week as it teeters near crucial support and resistance levels—support at $44,700 and $40,000 and resistance at $48,000 and $50,000. These thresholds could be key in determining BTC’s short-term trajectory, especially with the looming ETF decision that can significantly sway the market in either direction.

Navigating BTC’s Price Terrain Amidst ETF Speculations

With a robust $46,863, Bitcoin sits just below a significant resistance level of $48,000, with another critical milestone at $50,000. Conversely, support levels at $44,700 and $40,000 provide a cushion against potential downturns. The pending ETF decision is a wildcard in this scenario, with the potential to catapult Bitcoin to new heights or to test its support levels, depending on the outcome.

The Investment Rationale for BTC: A Story of Potential and Prudence

As the original cryptocurrency, Bitcoin is more than an investment; it symbolizes the crypto revolution. In the face of the upcoming ETF decision, BTC represents both a beacon of potential and a call for investor prudence.

Its blend of resilience and growth potential, intertwined with its pivotal role in the crypto narrative, secures its position in this week’s Bold 10. For investors, BTC offers an intriguing mix of stability and opportunity, underscored by the uncertainty and excitement of the ETF decision.

About Bitcoin (BTC)

Since its inception in 2009 by the enigmatic Satoshi Nakamoto, Bitcoin has evolved from a digital curiosity to a market leader, fundamentally altering the landscape of digital finance. As the first cryptocurrency, it introduced the world to blockchain technology and has since been a key driver in the proliferation of digital currencies.

Bitcoin’s decentralized nature and finite supply continue to draw investors, marking it as a cornerstone of the crypto market, especially as it navigates through pivotal moments like the upcoming ETF decision.

Tokens To Watch This Week #2 — Numeraire (NMR): A Steady Climb in the Crypto Landscape

Numeraire (NMR) is a token that has been catching the eye of savvy investors with its promising market indicators and strong momentum. Let’s dive into the details that make NMR a noteworthy contender in the crypto arena.

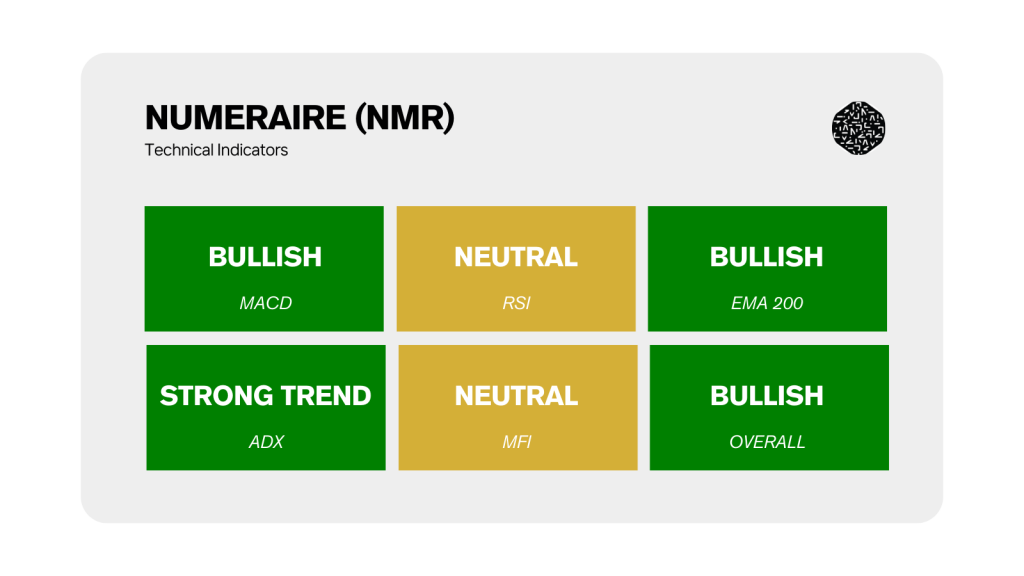

NMR’s Market Indicators: A Harmony of Bullish Signals

Numeraire’s market indicators paint a picture of a token in a confident stride. Its RSI stands neutral, indicating a balanced market position free from extreme fluctuations. The bullish MACD underscores a potential for continued upward price movements, aligning with the strong momentum observed recently. Furthermore, NMR’s consistent uptrend in EMA highlights a sustained positive sentiment among investors, suggesting a sturdy growth trajectory.

Navigating NMR’s Price Dynamics

Currently trading at an impressive $21, NMR is navigating a crucial phase, hovering near its resistance level of $25.

This point is a significant threshold, possibly opening doors to further ascents upon breakthrough. On the flip side, support levels at $17.4 and $15 provide a safety buffer, ensuring a level of stability amidst market volatility.

The Investment Case for NMR

Numeraire is not just an attractive investment due to its current market performance; it’s also a strategic choice for those looking to diversify into tokens with solid growth potential. The alignment of its technical indicators and its recent price performance positions NMR as a compelling pick in this week’s Bold 10.

For investors seeking to capitalize on tokens with balanced risk and robust growth prospects, Numeraire presents an intriguing opportunity.

About Numeraire (NMR)

Numeraire, the native token of the Numerai platform, stands out in the crypto space for its unique approach. Numerai is a hedge fund structured by a global network of data scientists who are incentivized through NMR tokens to create predictive financial models.

The innovative use of machine learning and crowdsourced intelligence in finance sets Numerai apart and adds a layer of sophistication to NMR’s role in the crypto ecosystem.

Want even more tokens to watch? Why You Should Watch Stacks, Kyber Network & 1Inch!

Tokens To Watch This Weeks #3 — Radicle (RAD): Emerging Strong in the Crypto Frontier

Let’s shine a light on Radicle (RAD), a token that’s making waves in the cryptocurrency world with its robust market indicators and firm performance.

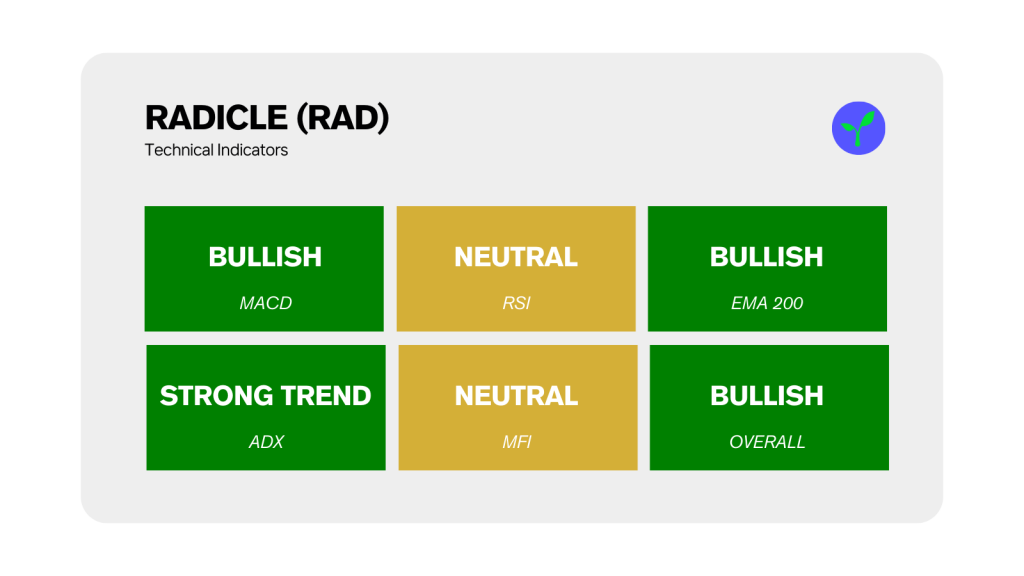

RAD’s Market Indicators: Signaling Strength and Growth

Radicle’s market indicators are aligning in a symphony of bullish signs. With an RSI firmly in the neutral zone, RAD demonstrates a market equilibrium, steering clear of overbought or oversold territories. The bullish MACD further accentuates the potential for upward price trends in harmony with RAD’s strong momentum. The bullish EMA trend also indicates sustained investor confidence and a positive outlook, reinforcing the token’s growth narrative.

Navigating RAD’s Price Landscape

Currently trading around $2.03, RAD is poised just below its resistance level of $2.05. This critical juncture presents a potential inflection point for the token, with a breakthrough possibly leading to new heights. Conversely, the support level at $1.38 offers a cushion against downward price movements, indicating a floor where investor interest may intensify.

The Investment Case for RAD

Radicle, with its solid technical indicators and growing market presence, presents more than just an investment opportunity—it’s a venture into innovation. Its balance of risk and reward, backed by solid market indicators, makes RAD an attractive proposition in this week’s Bold 10. Radicle offers an intriguing avenue for investors eyeing tokens with potential for growth and stability.

About Radicle (RAD)

Radicle is a decentralized network for code collaboration designed to provide an alternative to centralized code repositories. Radicle’s approach to leveraging blockchain technology for collaborative software development positions it uniquely at the crossroads of technology and community-driven innovation.

About CryptoKnowledge & the CryptoKnowledge App

At CryptoKnowledge, we pride ourselves on providing top-notch crypto data and tools. Our app is accessible on both the App Store and Play Store, featuring almost 200 crypto tokens and an array of functionalities like crypto signals, screeners, AI-based forecasts, and much more. Discover how we can elevate your trading experience, and download the app now!