In the rapidly changing world of cryptocurrencies, the Algorand (ALGO) token has caught the attention of many investors, traders, and financial analysts. However, its recent performance presents an interesting dilemma: How do you proceed when an asset shows overwhelmingly bearish signs yet also possesses the potential for a dramatic turnaround?

An Ominous Picture: The Curated Analysis

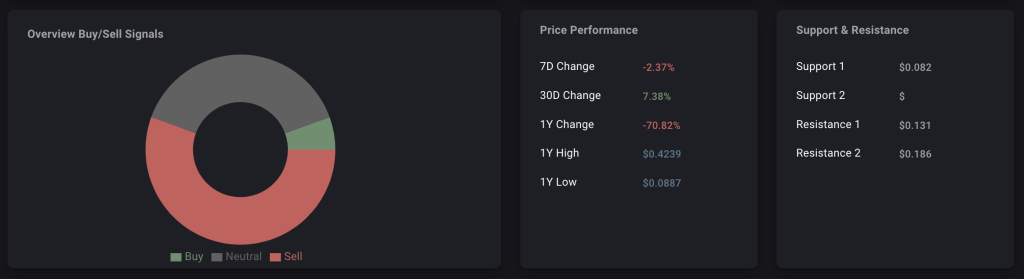

As of today, Algorand is trading at $0.096, marking a 1.23% decline. Over the past year, the token has experienced a precipitous drop of 70.82%, with a 1-year high and low of $0.4239 and $0.0887, respectively. This puts the token well below its previous high and edging dangerously close to its 1-year low.

→ Set up a trade alert for ALGO

Deep Learning Forecasts & Pattern Correlations

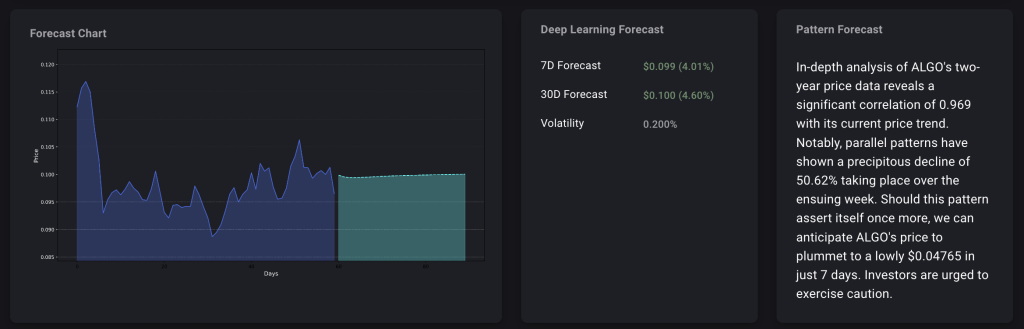

Advanced forecasting based on deep learning projects a modest increase in price over the next 7 to 30 days, with gains expected to be around 4.01% to 4.60%.

While this might appear promising, the two-year price data reveals a troubling correlation of 0.969 with its current price trend, which suggests a possible free fall to as low as $0.04765 within a week. The metrics, quite bluntly, are urging investors to tread cautiously.

Support & Resistance: Critical Levels to Watch

- Support 1: $0.082

- Resistance 1: $0.131

- Resistance 2: $0.186

With these levels in mind, traders can set up strategic entry and exit points, although the overall sentiment suggests heightened caution.

Trend Indicators & Momentum

Across the board, trend indicators are pointing downward, strengthening the bearish outlook:

- Short EMA, Medium EMA, Long EMA: All in a downtrend

- Short SMA, Medium SMA, Long SMA: All in a downtrend

- ADX: Weak

- Momentum Indicators: RSI, MACD, Stochastic Oscillator, Williams R, MFI, and Stochastic RSI are all neutral to bearish.

What Do These Patterns Mean?

These patterns essentially signal a strong bearish tendency. But note this is not financial advice but a synthesis of the data at hand. Financial markets are unpredictable, and while historical data can offer insights, they don’t guarantee future performance.

Is There a Silver Lining?

While the deep learning forecast and trend indicators present a bleak picture, it’s essential to remember that the crypto market is highly volatile. Significant news, updates, or partnerships can turn things around very quickly. So, should you decide to invest, ensure that it’s money you can afford to lose and that you’ve considered all the risk factors.

Practical Tips for ALGO Traders

- Set Alerts: With the data suggesting a potentially sharp decline, setting price alerts can help you manage the risk.

- Diversify: Never put all your eggs in one basket. If you’re keen on ALGO, make sure it’s a part of a diversified portfolio.

- Stay Updated: Follow Algorand’s official channels and watch market news. Sometimes, news can be the catalyst for a significant price change.

Wrapping Up

Given the uncertain outlook for Algorand (ALGO), potential investors should exercise extreme caution. While the technology behind Algorand is promising, its current market indicators suggest that now might be a time for caution rather than bold action. Keep your eyes peeled, your alerts set, and most importantly, never invest more than you can afford to lose.

Your Next Step(s)

→ Check out the CryptoKnowledge for more ALGO details & data

→ Start trading ALGO