Today, we delve deep into the current state and prospective outlook of the Compound (COMP) token, a prominent player in the decentralized finance space. Through a comprehensive analysis spanning price trends, technical indicators, and trade recommendations, we aim to provide a holistic view of COMP’s potential trajectory in the coming days.

Let’s get right into it!

Check out our latest article about Ethereum and Bitcoin

→ Ethereum’s September Analysis: Key Insights and Trade Recommendations

→ Bitcoin Price Update: Your Week-Ahead Outlook Unpacked!

Compound (COMP) — Price Analysis

COMP is priced at $39.35 at the time of writing, marking a 5.46% increase in the last 24 hours.

However, taking a step back to assess its performance over broader timeframes paints a more nuanced picture. In the past week, the token has slipped by 2.07%, a decline of 9.66% over the last month.

The contraction is even more pronounced on a yearly scale, standing at -13.82%. This descending trend suggests that investors have been cautious towards COMP recently. However, it is worth mentioning that the decline is relatively meager compared to most other altcoins.

Compound (COMP) — Technical Indicators Analysis

Trend Indicators

To fully grasp the current market sentiment surrounding Compound (COMP), analyzing various trend indicators is crucial.

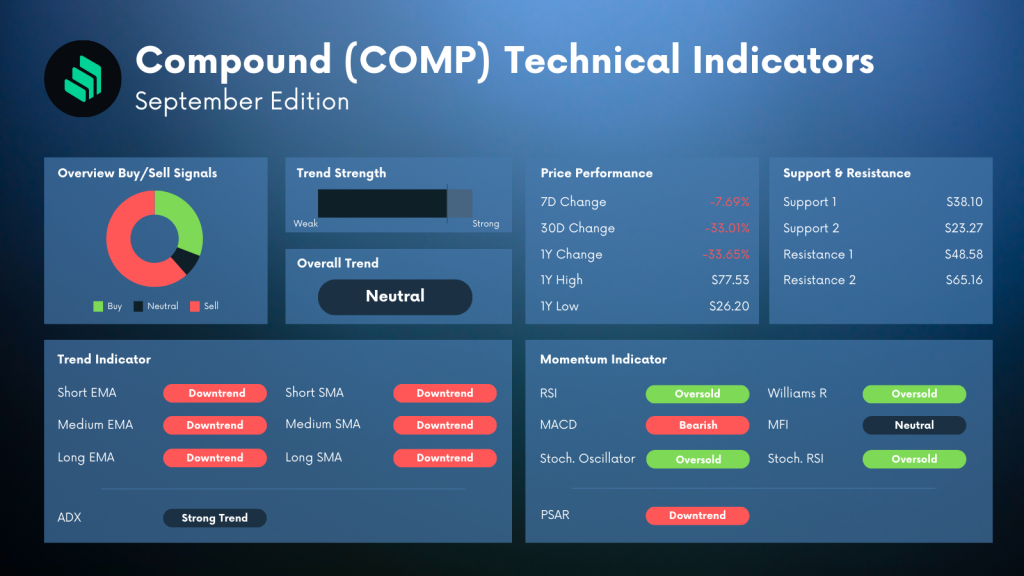

Both short- and medium-term Exponential Moving Averages (EMAs) and Simple Moving Averages (SMAs) indicate a downtrend across all timeframes.

| Indicator | Trend |

| Short SMA | Downtrend |

| Medium SMA | Downtrend |

| Long SMA | Downtrend |

| Short EMA | Downtrend |

| Medium EMA | Downtrend |

| Long EMA | Downtrend |

The Average Directional Index (ADX) corroborates the downtrend, which signals a strong trend, despite the overall trend being labeled as neutral. This juxtaposition of a neutral overall trend with strong individual indicators suggests a market teeming with potential volatility.

More Compound (COMP) Analysis

→ Compound (COMP): New Heights or Due for a Breather?

→ Riding the Compound Wave: Why COMP Is Poised For Another 10% Surge

→ Compound (COMP) in September: A Straightforward Analysis and Trade Recommendation

Compound (COMP) — Momentum Indicators

In this chapter of our Compound (COMP) analysis, we turn our focus toward momentum indicators. The Relative Strength Index (RSI), Stochastic Oscillator, and the Williams %R all point toward an oversold territory, hinting at a potential corrective rally in the near future.

Conversely, the Moving Average Convergence Divergence (MACD) maintains a bearish stance, implying that there might be further dips ahead. The Money Flow Index (MFI) remains neutral, leaving room for potential shifts in either direction, whilst the Stochastic RSI also finds itself in an oversold position, echoing sentiments of a possible rebound.

| Indicator | Value |

| RSI | Oversold |

| Stochastic Oscillator | Oversold |

| Williams R | Oversold |

| MACD | Bearish |

| MFI | Neutral |

| Stochastic RSI | Oversold |

| PSAR | Bearish |

Trade Recommendation

Based on the current technical analyses, traders should exercise caution and vigilance. Considering the downtrend exhibited across various indicators, it may be prudent to adopt a wait-and-see strategy before making any substantial investments.

Investors keen on entering the market could potentially look for opportunities to buy at lower levels, capitalizing on the oversold conditions hinted at by several momentum indicators.

However, every entry should wait for the token to break through the resistance at $40 (see chart). Once this is accomplished, the next major resistance lies at $53.

About Compound

Compound is a decentralized finance protocol allowing users to borrow cryptocurrencies. The

token serves as the governance token for the Compound protocol, enabling holders to propose and vote on changes to the system. Despite recent market reticence, its pioneering efforts in the DeFi space have cemented its position as a significant player.

Summary

In conclusion, the Compound (COMP) token is currently navigating through turbulent waters, as evidenced by its recent price performance and technical indicators. The strong downtrend signals and a slew of oversold momentum indicators create a complex landscape for potential investors.

As the crypto market is known for its swift reversals and trend shifts, staying informed and alert is the key to navigating these choppy seas. Moving forward, keeping a close eye on market developments and adapting strategies accordingly will be pivotal for prospective investors in COMP.

Your Next Step(s)

→ Check out the CryptoKnowledge Platform and enhance your trading skills

→ Start trading COMP