For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

In the ever-fluctuating world of cryptocurrency, staying ahead with timely and detailed forecasts is crucial for traders. This article provides a comprehensive 24-hour forecast for ten different crypto tokens, focusing on their current trends, technical indicators, and overall market positions. We aim to equip traders with insightful information for strategic short-term trading.

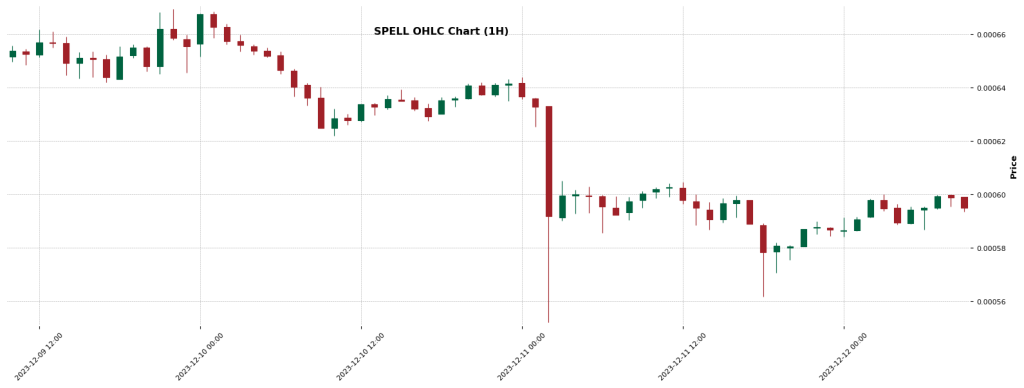

SPELL Token: Complex Market Dynamics

24-Hour Forecast: SPELL’s immediate future appears challenging. The AI forecasts a downward trend, which might seem contradictory given the bullish MACD and upward movement in both long and short-term EMAs. This complex situation is further compounded by an overbought RSI, suggesting the market might be saturated. Traders should closely monitor SPELL for any signs of reversal or confirmation of the forecasted downtrend.

Market Insight: SPELL, active in many markets, has shown volatility in its recent performance. Its operation on the Ethereum platform adds to its potential for rapid changes.

RLC: Navigating Uncertainty

24-Hour Forecast: RLC presents a scenario of uncertainty with a forecasted upward trend. A neutral RSI and a bearish MACD temper this optimism. The uptrends in both long and short-term EMAs indicate potential growth, but this mixed signal scenario requires traders to be vigilant for sudden market shifts.

Token Overview: As an Ethereum-based cryptocurrency, RLC has maintained a stable presence in the market, suggesting potential resilience against unpredictable market forces.

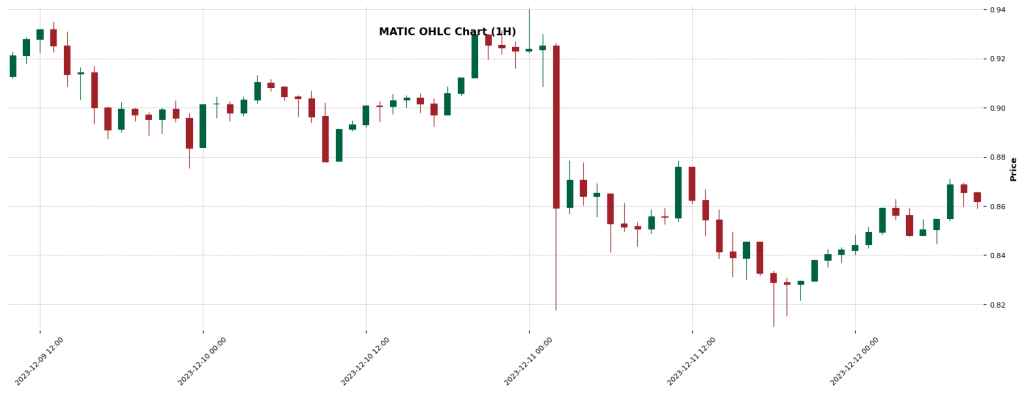

Polygon (MATIC): Downtrend with a Bullish Undertone

24-Hour Forecast: Despite a bearish 24-hour forecast, MATIC shows bullish signals with MACD and EMA trends. This conflicting scenario indicates a potential for both risk and opportunity. Traders should consider this a critical period to watch for any deviation from the expected downward trajectory.

Market Position: With its strong market presence and recent price increase, MATIC remains a significant player in cryptocurrency.

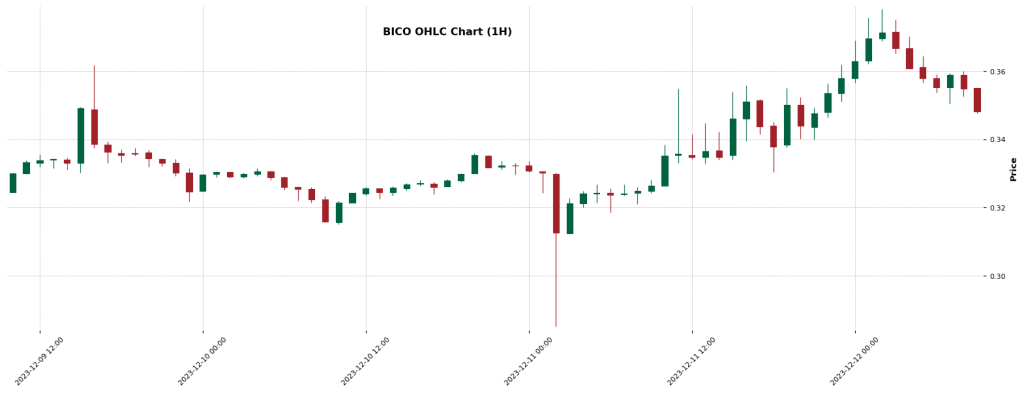

Biconomy (BICO): Contrasting Indicators

24-Hour Forecast: BICO is predicted to face a downward trend despite bullish indicators like the MACD and EMA trends. This contrast suggests a market tension that traders must navigate carefully, looking for signs that might tip the balance in either direction.

Token Dynamics: Though relatively new, BICO has shown a notable performance in the market, indicating its potential for volatility and rapid shifts.

Gas (GAS): Downward Trend Amidst Positive Indicators

24-Hour Forecast: GAS faces a somewhat likely downturn, challenging its current uptrend in EMAs. The bearish MACD and a neutral RSI add layers of complexity to its short-term trajectory. This period could be crucial for traders to discern the dominant market trends and adjust their strategies accordingly.

Background: Active on the Neo platform, GAS’s recent price decrease aligns with the forecast, though its active market presence suggests the possibility of fluctuations.

AirSwap (AST): Facing Market Headwinds

24-Hour Forecast: The likely decline in AST’s value in the next 24 hours, despite a bullish MACD, suggests a market correction or a reaction to overvaluation. The neutral RSI points to a balanced market sentiment, which might not be strong enough to counter the downward pressure.

Market Overview: AST’s market presence and recent uptick indicate its potential to bounce back from short-term declines.

dYdX (DYDX): Poised for an Upsurge

24-Hour Forecast: DYDX presents an interesting case with a forecasted upward trend, countering its bearish MACD and short-term EMA downtrend. This scenario could signify a market gearing up for a rebound, making it an intriguing option for traders looking for growth opportunities.

Token Insight: As a relatively new entrant, DYDX has demonstrated significant growth, aligning with its positive short-term forecast.

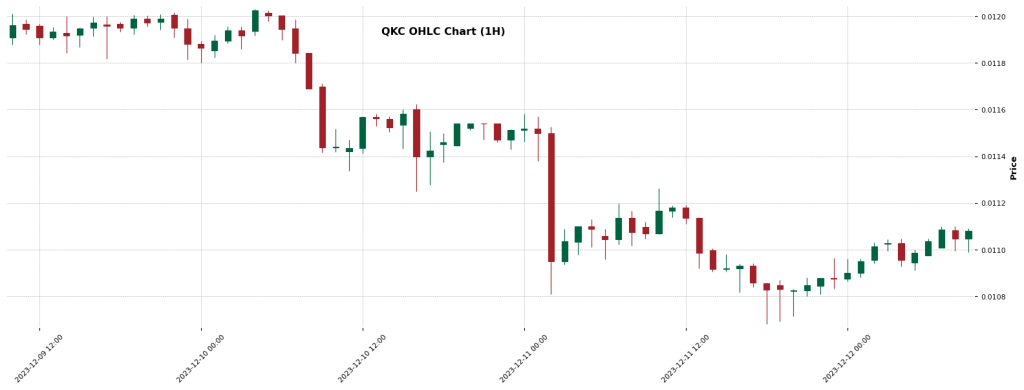

QuarkChain (QKC): A Likely Decline

24-Hour Forecast: QKC is projected to experience a decline, but with bullish indicators in the background, this downturn might be short-lived or less severe than anticipated. Traders should stay alert for any early signs of recovery or further decline.

Current Status: Its recent market performance and active trading suggest a token with the potential for swift changes.

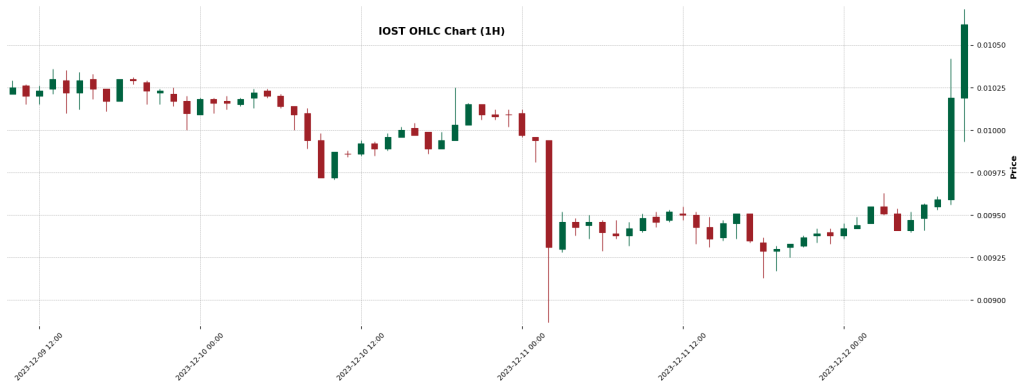

IOST: Short-Term Challenges

24-Hour Forecast: The forecast for IOST points to a downward trend, but with bullish MACD and EMA trends, this could be a temporary dip. Traders might find opportunities in these short-term fluctuations.

Market Perspective: IOST’s recent rise in the market hints at its resilience and ability to defy short-term bearish forecasts potentially.

Conclusion

This detailed 24-hour forecast of crypto tokens reveals a landscape filled with opportunities and risks. Traders must consider these forecasts alongside the current market dynamics and technical indicators to make informed decisions. The crypto market’s inherent volatility calls for continuous vigilance and a strategic approach to short-term trading.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now