The cryptocurrency market is ever-changing, where AI-driven forecasts can be a key tool for traders. This article explores the 24-hour AI forecasts for various tokens, analyzing their technical indicators and market context to provide a comprehensive outlook.

Let’s dive into each token’s forecast and its implications for trading strategies.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

THETA Network: Upward Momentum on the Horizon

According to AI predictions, THETA Network (THETA) shows a somewhat likely upward trend in the next 24 hours. Despite the bearish MACD, both the long and short EMAs indicate an uptrend, and the RSI is neutral, suggesting stability. This mixed signal presents an interesting scenario for traders.

The token’s considerable trading activity and its recent downtrend highlight the potential for a reversal, aligning with the AI’s upward forecast.

The Graph (GRT): A Bullish Outlook

The Graph (GRT) is projected to experience an upward movement, with AI forecasting this as likely. This prediction is reinforced by bullish MACD and uptrends in both long and short EMAs. The neutral RSI indicates a balanced market sentiment. Given GRT’s active market presence and its recent downturn, this forecast might signal an opportune moment for traders to consider entry points.

PancakeSwap (CAKE): Rising Despite Bearish Indicators

PancakeSwap (CAKE) also sees a somewhat likely upward trend in the next 24 hours. Interestingly, this comes amid a bearish MACD but is supported by upward trends in both long and short EMAs and a neutral RSI. CAKE’s significant market activity and recent decline might suggest the potential for a rebound, aligning with the AI’s forecast.

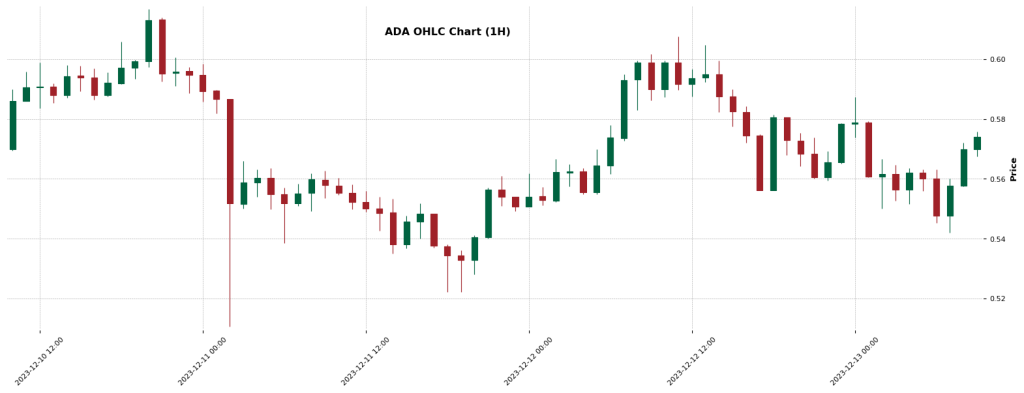

Cardano (ADA): A Positive Turn Amid Overbought Conditions

Cardano (ADA) is forecasted to have an upward trend despite an overbought RSI. A bullish MACD and uptrends in EMAs further support this bullish outlook. Considering ADA’s extensive trading volume and recent price drop, this forecast could indicate a short-term recovery opportunity for traders.

Stacks (STX): A Contradictory Downward Prediction

Stacks (STX) is facing a somewhat likely downward forecast, contradicting the bullish MACD and the uptrends in both long and short EMAs. The neutral RSI adds to this complexity. Traders might need to exercise caution and closely monitor market developments, considering STX’s recent negative performance.

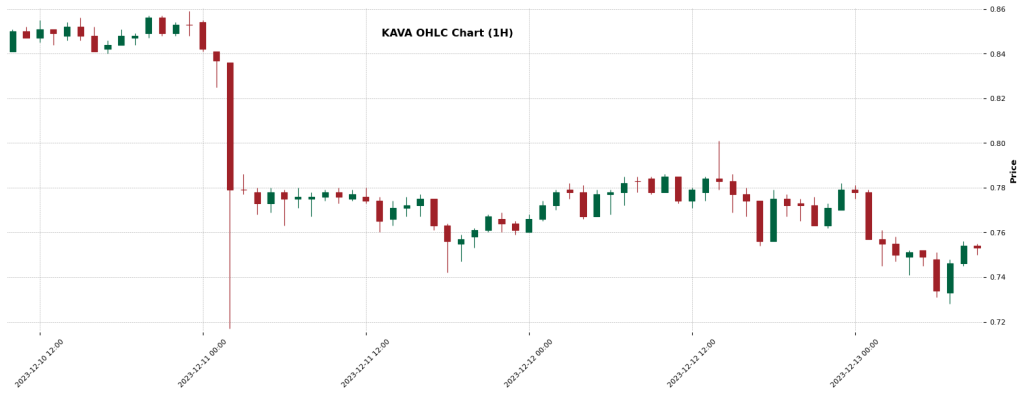

Kava (KAVA): Downward Trend Amidst Bullish Indicators

Kava (KAVA) is predicted to trend downwards despite bullish MACD and uptrend signals from both long and short EMAs. The neutral RSI does not offer a clear direction, suggesting a challenging trading environment. KAVA’s recent price decrease could be a factor in this forecast, warranting a careful approach from traders.

Terra Classic (LUNC): Likely Downward Movement

Terra Classic (LUNC) faces a likely downward forecast, which is at odds with its bullish MACD and uptrend EMAs. The neutral RSI indicates a lack of strong market sentiment. Given LUNC’s high trading activity and recent downturn, this forecast might suggest a continuation of the negative trend.

Discover more AI Forecasts:

Crypto AI Forecast — 12th December 2023 (MATIC, SPELL, DYDX, and more)

Bluzelle (BLZ): An Uptick on the Cards

Bluzelle (BLZ) is expected to trend upwards, which is somewhat likely, according to the AI. This aligns with its bullish MACD and uptrend EMAs. The neutral RSI points to a stable market condition. BLZ’s recent positive performance and active trading suggest that this forecast could hold true, offering potential for traders.

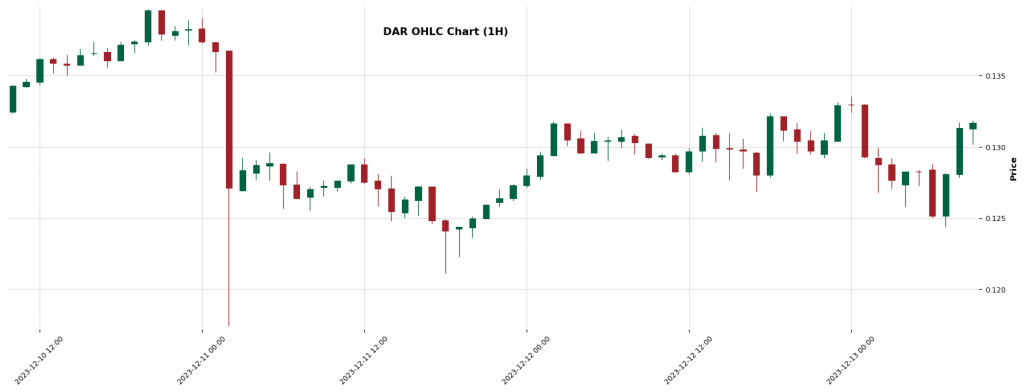

Mines of Dalarnia (DAR): Uncertainty in Downward Forecast

Mines of Dalarnia (DAR) faces an uncertain downward trend. Despite bullish MACD and uptrend EMAs, this forecast presents a conflicting scenario. The neutral RSI further adds to the uncertainty. Given DAR’s recent uptick in price, traders might need to be cautious and watchful of market shifts.

Conclusion

These 24-hour AI forecasts for various crypto tokens present diverse trading opportunities and challenges. Traders must consider these alongside other market indicators and recent performance trends to make informed decisions. The dynamic nature of the crypto market means that vigilance and adaptability are key to navigating these short-term forecasts effectively.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now