In the fluctuating landscape of cryptocurrency, AI forecasts serve as a guiding light for traders and investors. These forecasts provide a snapshot of potential market movements by analyzing various technical indicators.

In this article, we will explore the AI forecasts for a range of cryptocurrencies, discussing each token’s current market situation and the implications of these forecasts.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

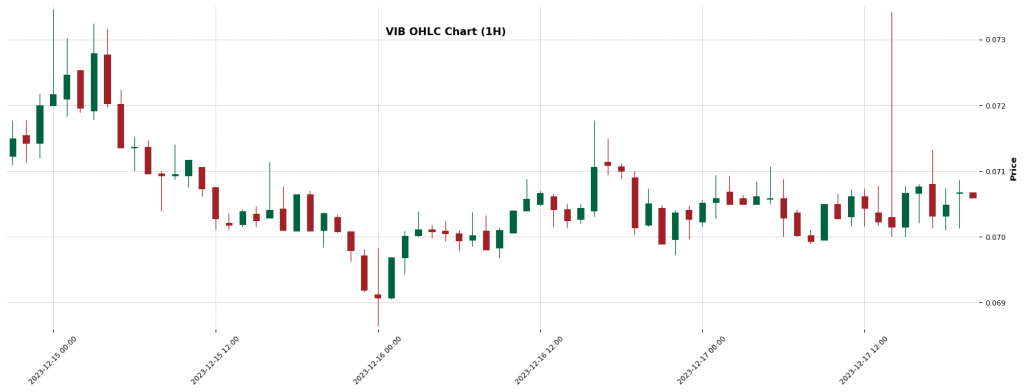

VIB (Viberate): Anticipating a Downward Trend

Viberate currently shows a likely downward trend, according to the 24-hour AI forecast. This is supported by a bearish MACD and downtrends in both long and short EMAs, despite a neutral RSI. Currently priced at 0.07 USD with a slight increase, VIB’s trading activity in 35 markets suggests potential volatility.

Traders should closely watch market dynamics and consider the bearish indicators in their decision-making process.

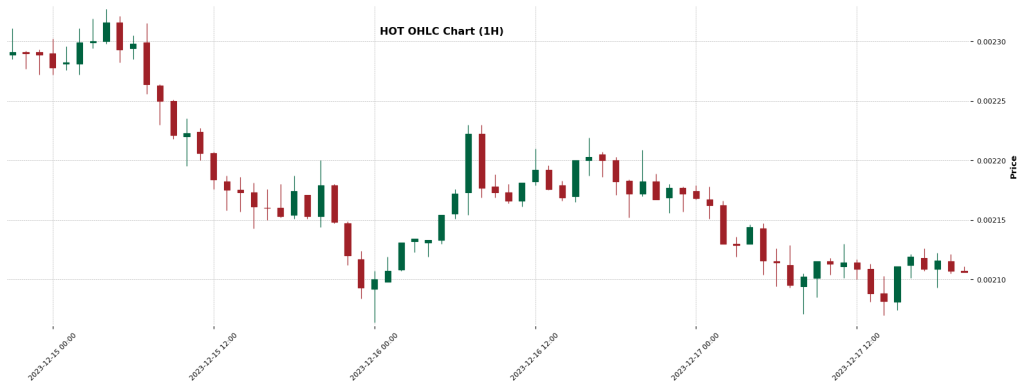

HOT (Holo): Potential Decline Ahead

The AI forecast for Holo predicts a likely downward movement despite conflicting indicators. The RSI is overbought, yet the MACD is bullish, and both long and short EMAs are uptrend.

Currently trading at 0.002111 USD with a 3.48% decrease, HOT’s market activity in 175 markets indicates that traders should be cautious of a potential reversal or correction.

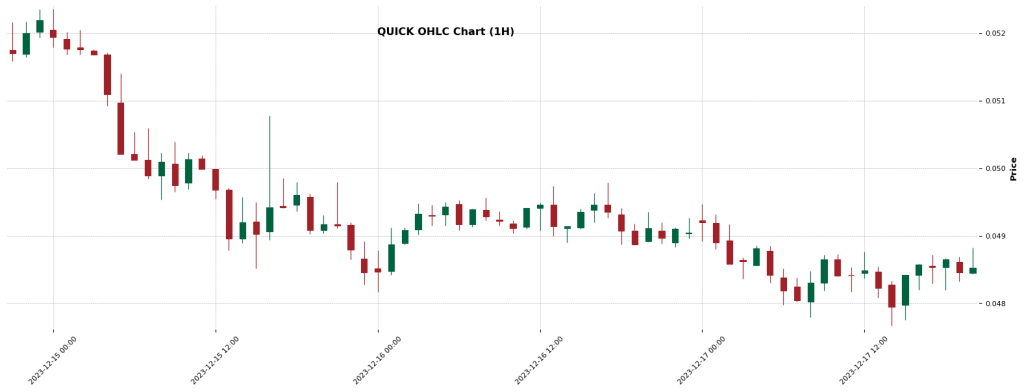

QUICK (Quickswap [New]): Uncertain Downward Forecast

According to the AI analysis, Quickswap [New] has an uncertain downward forecast. With a neutral RSI and mixed signals from the MACD and EMAs, QUICK’s market situation is complex.

Its current price is 0.0486 USD, down by 0.96%. Traders should pay attention to market trends and consider the uncertain nature of the forecast in their strategy.

KLAY (Klaytn): Optimistic Uptrend Forecast

Klaytn shows a somewhat likely upward trend, as suggested by the AI forecast. KLAY appears poised for growth with a neutral RSI, bullish MACD, and uptrends in both long and short EMAs.

Currently at 0.252 USD with a 2.46% decrease, KLAY’s extensive trading across 237 markets highlights its potential for recovery and growth.

ACM (AC Milan Fan Token): Likely Upward Movement

The AI forecast for AC Milan Fan Token indicates a likely upward movement despite bearish indicators from the MACD and downtrends in both long and short EMAs.

Trading at 1.87 USD with a minor decrease of 0.10%, ACM’s activity in 36 markets suggests that the bullish forecast could override the current bearish indicators.

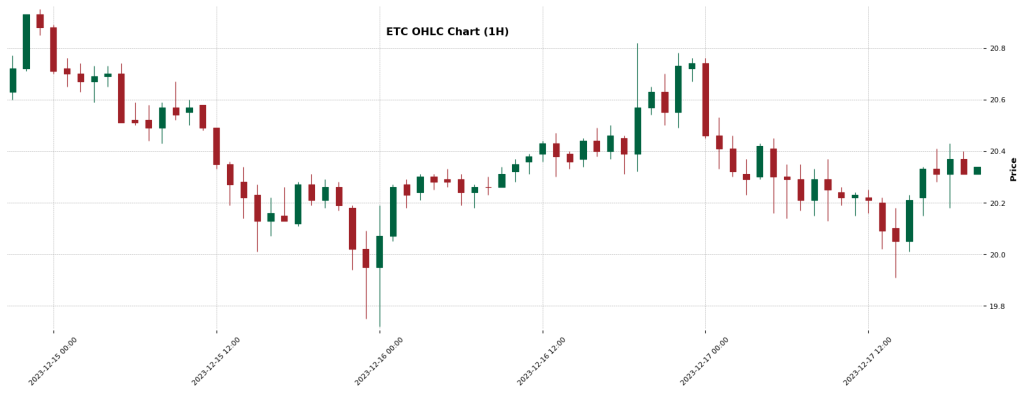

ETC (Ethereum Classic): Somewhat Likely Uptrend

Ethereum Classic’s AI forecast points towards a somewhat likely uptrend, supported by a neutral RSI and bullish MACD, although the EMAs present mixed signals.

ETC’s price is currently 20.30 USD, down by 1.31%, and its widespread trading in 474 markets indicates significant interest and potential for growth.

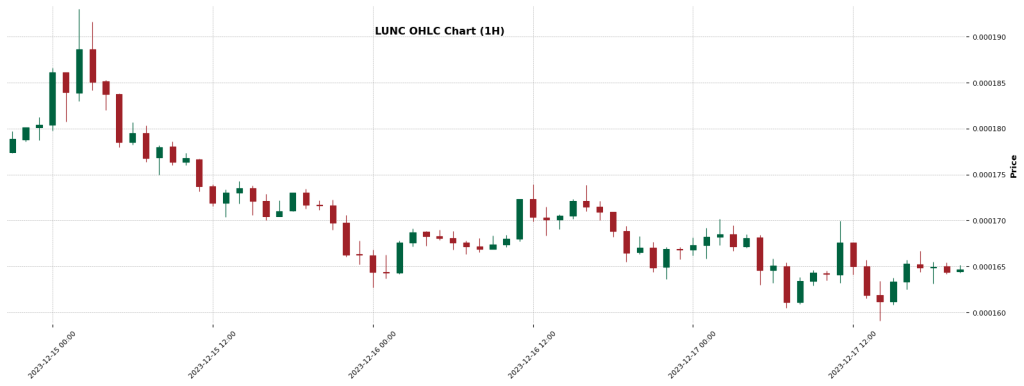

LUNC (Terra Classic): Uncertain Downward Trend

The AI forecast for Terra Classic indicates an uncertain downward trend.

This is intriguing, given the bullish MACD and uptrends in both long and short EMAs. LUNC’s current price is 0.00016457 USD, down by 1.54%, and its trading activity across 461 markets suggests that the token might experience volatility in the short term.

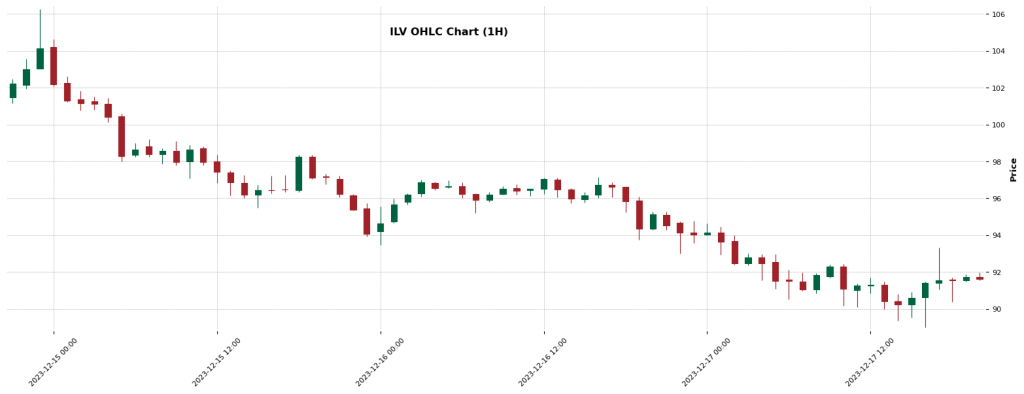

ILV (Illuvium): Promising Uptrend

Illuvium is forecasted to experience an uptrend, as per the AI analysis likely.

Despite a bearish MACD, EMAs’ neutral RSI and uptrends suggest potential growth. Currently priced at 91.73 USD with a 2.69% decrease, ILV’s market presence in 141 markets indicates a robust interest that could drive its growth.

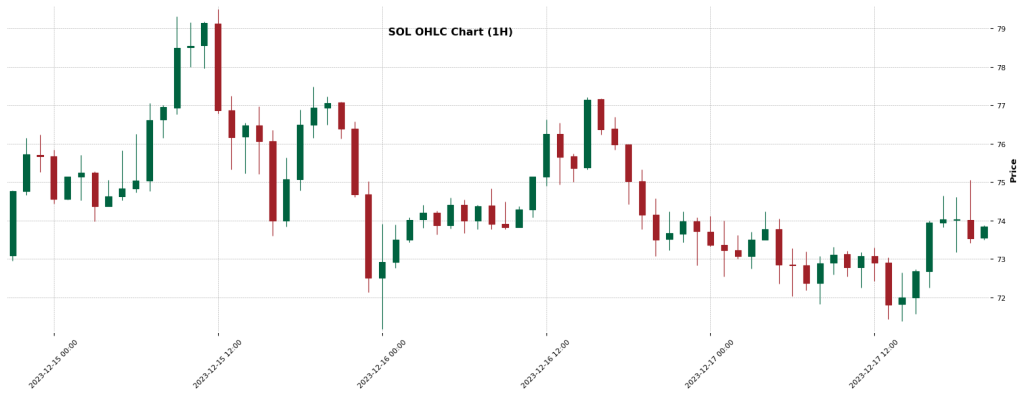

SOL (Solana): Downward Trend Likely

Solana’s AI forecast suggests a somewhat likely downward trend, conflicting with bullish indicators from the MACD and both long and short EMAs in the uptrend.

Currently at 73.53 USD with a minor decrease, SOL’s extensive trading across 562 markets could mean the token might defy the downward forecast.

STX (Stacks): Anticipated Downward Movement

Stacks faces a somewhat likely downward trend, according to the AI forecast.

Despite this, the indicators present a bullish MACD and uptrends in EMAs, with a neutral RSI. Trading at 1.03 USD with a 2.62% increase, STX’s significant trading volume in 133 markets suggests that the forecast might not fully align with the market sentiment.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now