For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

In the volatile realm of cryptocurrency trading, understanding short-term trends is crucial for making informed decisions. This article delves into the 24-hour AI forecasts for several cryptocurrencies, analyzing their technical indicators and market performance to aid traders in their short-term strategies.

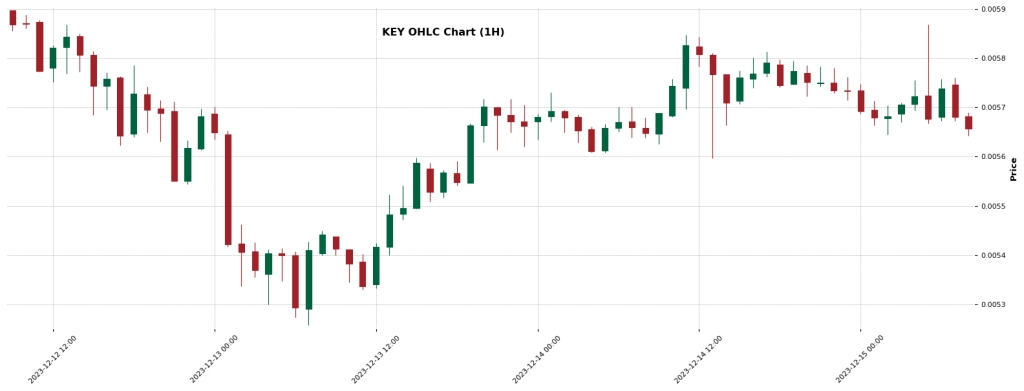

SelfKey (KEY): A Downward Trajectory

According to the AI forecast, SelfKey (KEY) faces a somewhat likely downward trend. This is aligned with its bearish MACD and downtrends in both long and short EMAs. Despite a neutral RSI, KEY’s current price of 0.0056 USD and recent 0.04% decline suggest caution for traders. Active trading across 93 markets indicates a need for vigilant market analysis.

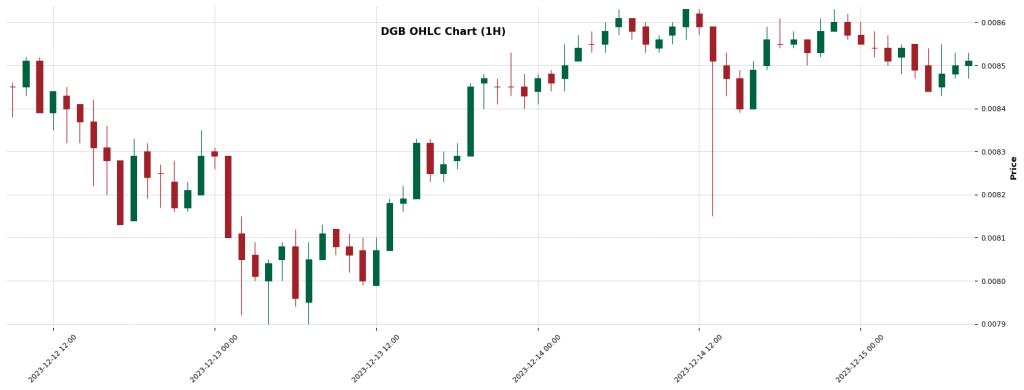

DigiByte (DGB): Uncertainty Looms

DigiByte (DGB) presents an uncertain downward forecast. While its RSI remains neutral, a bullish MACD contradicts the AI prediction. The uptrend in both long and short EMAs could indicate potential resilience. Currently priced at 0.0085 USD, DGB’s recent 1.00% drop, coupled with trading on 133 markets, highlights the importance of closely monitoring market movements.

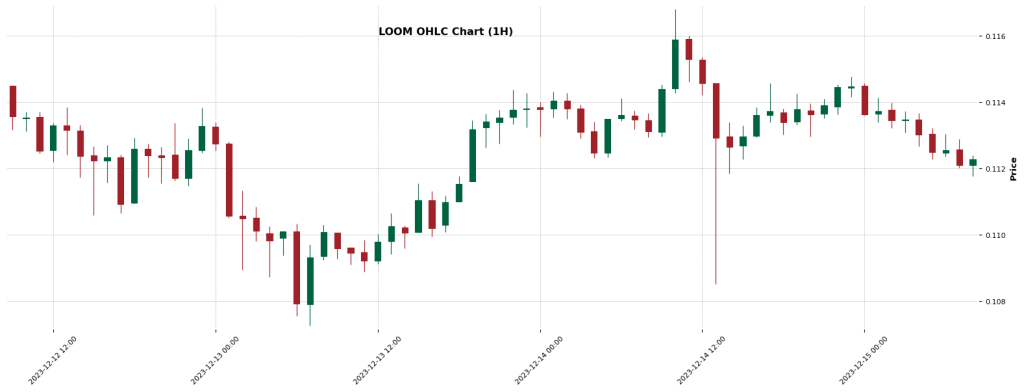

Loom Network (LOOM): Very Likely Downward Movement

LOOM Network is forecasted to experience a very likely downward trend. This prediction is supported by bearish MACD and downtrends in both EMAs despite a neutral RSI. Priced at 0.11224133 USD with a recent 1.23% decrease, traders in LOOM’s 128 active markets should prepare for potential declines.

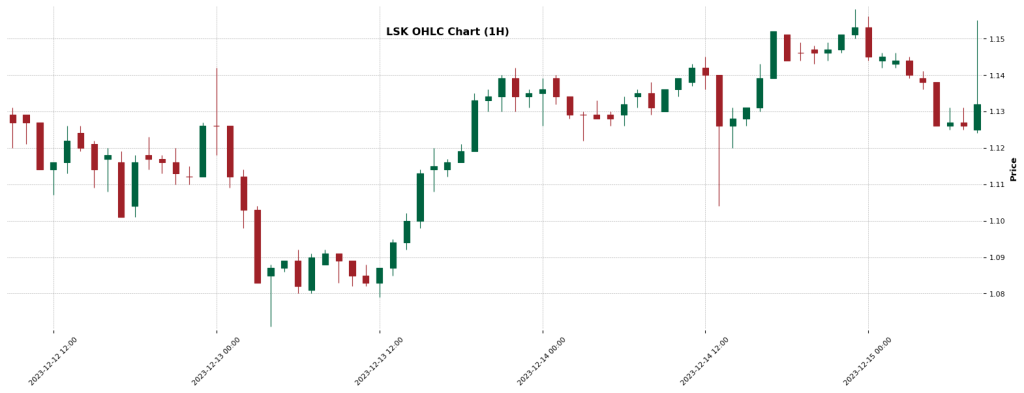

Lisk (LSK): A Ray of Hope

Lisk (LSK) shows a somewhat likely upward trend, creating an interesting contrast with its bearish MACD and short EMA downtrend. The neutral RSI and long EMA uptrend add complexity to this forecast. With a current price of 1.12772671 USD and a recent 0.82% drop, LSK’s activity in 77 markets demands careful analysis of potential opportunities.

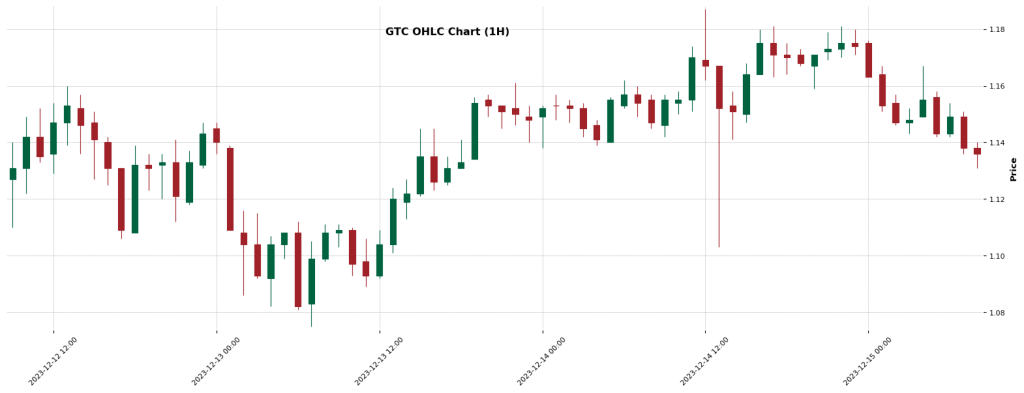

Gitcoin (GTC): Uncertain Uptrend

Gitcoin (GTC) faces an uncertain upward forecast despite a bearish MACD and a neutral RSI. The uptrends in both long and short EMAs suggest potential for growth. Currently trading at 1.13554397 USD, despite a 1.72% fall, GTC’s presence in 113 markets underscores the need for cautious optimism.

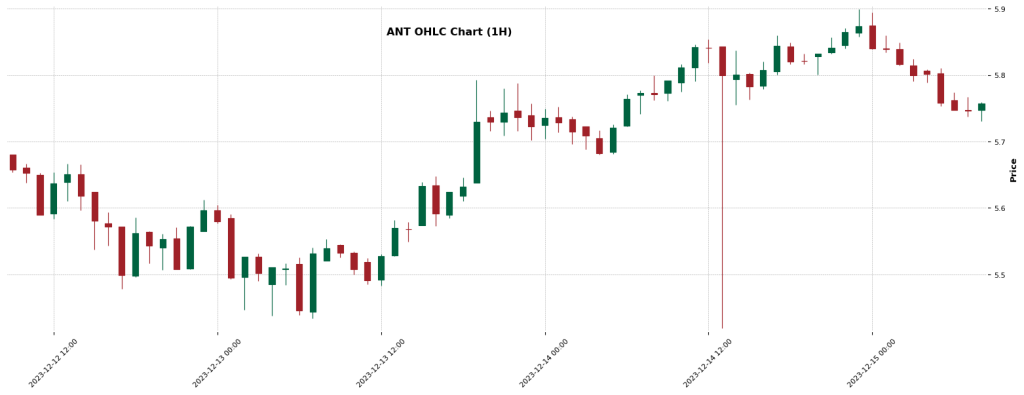

Aragon (ANT): Downward Movement Ahead?

Aragon (ANT) exhibits an uncertain downward trend per the AI forecast. This comes amidst a bearish MACD but conflicting uptrends in EMAs and a neutral RSI. Priced at 5.74905681 USD with a slight 0.66% recent decrease, ANT’s active trading on 162 markets requires traders to stay alert to shifting trends.

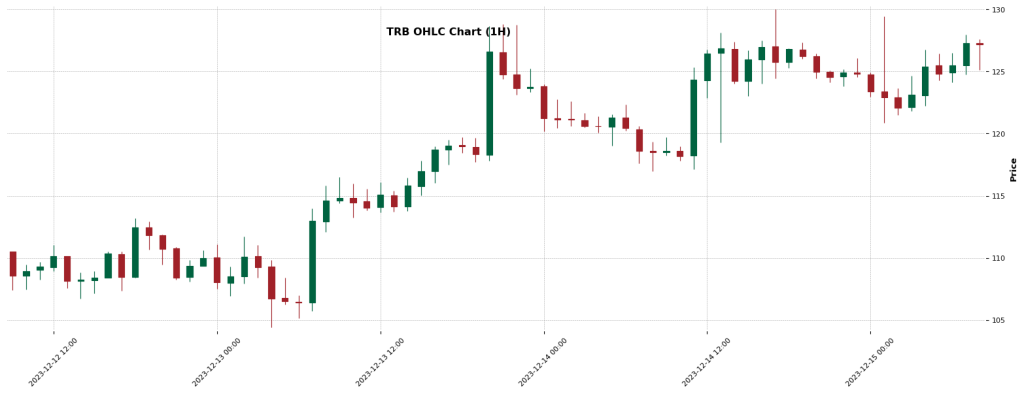

Tellor (TRB): Contradictory Signals

Tellor (TRB) is forecasted to trend downward, which is somewhat likely. However, this is contrasted by an overbought RSI and bullish MACD, along with uptrends in both EMAs. Currently at 125.80866844 USD and up 5.58%, TRB’s trading activity in 140 markets indicates that traders should exercise caution and seek confirmation of trends.

Conclusion

In conclusion, these 24-hour AI forecasts for various cryptocurrencies offer a glimpse into potential short-term market movements. Traders must consider these forecasts alongside current market dynamics, technical indicators, and recent performance to inform their trading strategies. The fast-paced nature of the cryptocurrency market necessitates a vigilant and adaptable approach to capitalize on these short-term trends effectively.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now