The world of cryptocurrency trading is a labyrinth of complex patterns and signals, with traders constantly seeking to decode the next big trend.

In this article, we delve into recent trading signals detected for various tokens, each with its unique story told through the lens of market indicators like MACD, RSI, and EMA. Let’s explore these signals in detail, understanding their implications and potential impact on trading strategies.

All signals are based on the hourly chart!

We will explore each token’s detected signal, support and resistance levels, profit potential, and backtest data to equip traders with information crucial for informed decision-making.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

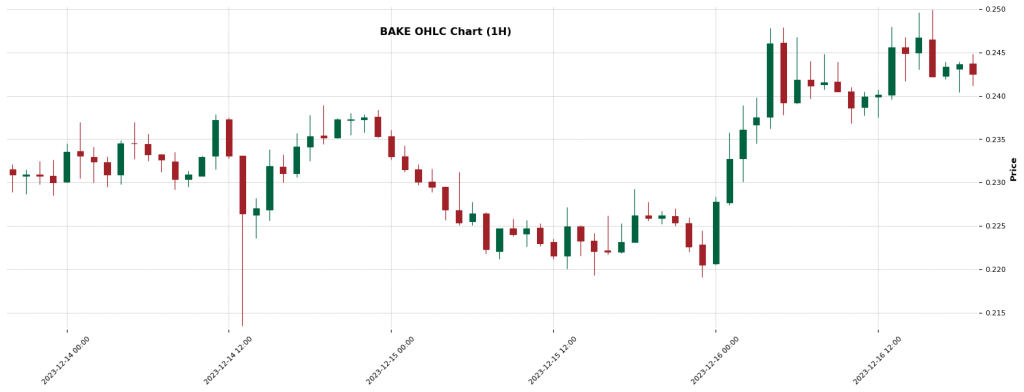

BAKE: Bearish Crossover Signals Caution

BAKE has recently exhibited a ‘MACD: Bearish Crossover,’ signaling a potential downward trend. With current support and resistance levels at $0.23 and $0.25, respectively, the token shows a moderate profit potential of 3.6%.

However, backtesting results paint a challenging picture, with a success rate of 55.42% and a profit potential of 9%, suggesting that traders should approach cautiously and closely monitor market movements.

RNDR: Overbought Territory Indicates Caution

RNDR shows an ‘RSI: Overbought’ signal, which often indicates a potential for price pullback or consolidation. With support at $4.27 and resistance at $5.11, the token offers a significant profit potential of 6.4%. Unfortunately, no backtest information is available for this specific signal for RNDR.

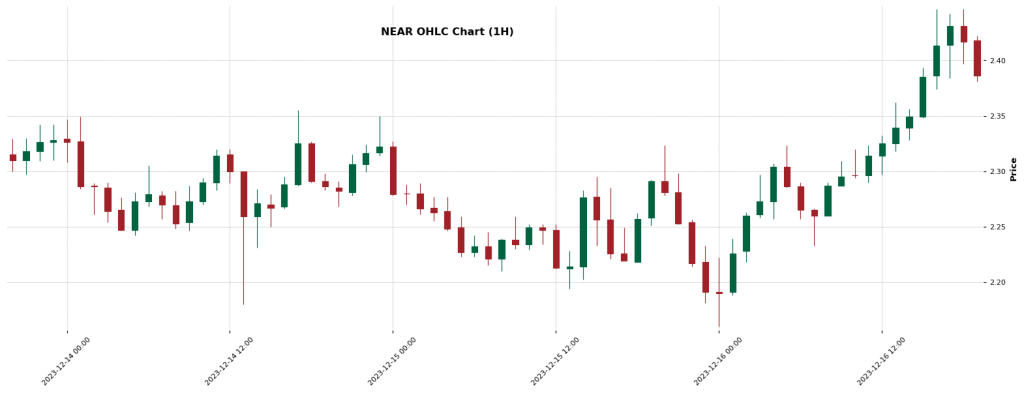

NEAR: Overbought but with Positive Backtesting

NEAR’s ‘RSI: Overbought’ signal is intriguing, especially considering its backtesting success rate of 59.28% and a high profit potential of 42%. With support at $2.22 and resistance at $2.53, NEAR shows a promising profit potential of 5.3%, though the overbought condition suggests that traders should be vigilant for any signs of reversal.

TRB: Bearish Crossover Demands Caution

TRB’s ‘MACD: Bearish Crossover’ indicates a potential downward movement. The token has support at $95.75, resistance at $143.05, and a high-profit potential of 26.34%. However, its backtest data, with a success rate of only 50.1% and a profit potential of 6%, calls for careful analysis before making any trading decisions.

Check out even more crypto signals:

Crypto Trading Signals — 14th December 2023 (LUNC, SAND, AGIX, and many more)

Crypto Trading Signals — 13th December 2023 (HBAR, ADA, HIVE, and many more)

Crypto Trading Signals — 12th December 2023 (BTC, DOT, ADA, DOGE, and more

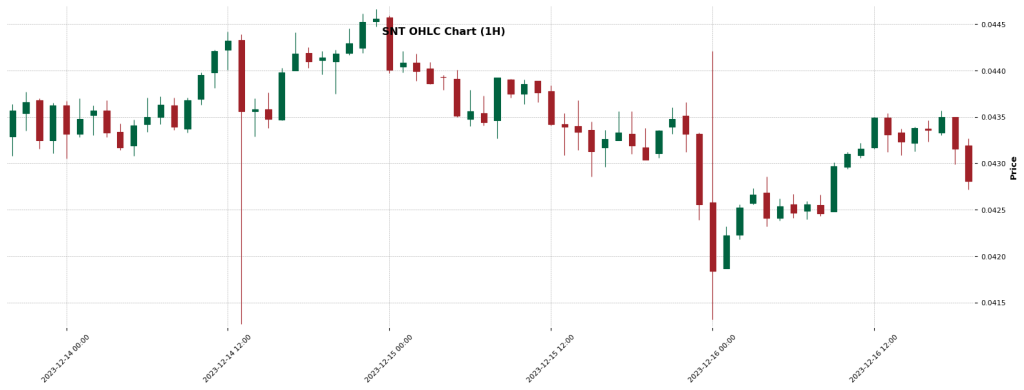

SNT: Bullish Crossover Presents Opportunities

SNT presents an ‘EMA: Bullish Crossover,’ a positive signal for potential upward momentum. With support and resistance at $0.0428 and $0.0437, respectively, and a modest profit potential of 1%, combined with a backtest success rate of 65.15% and a profit potential of 5.7%, SNT could be an attractive option for traders.

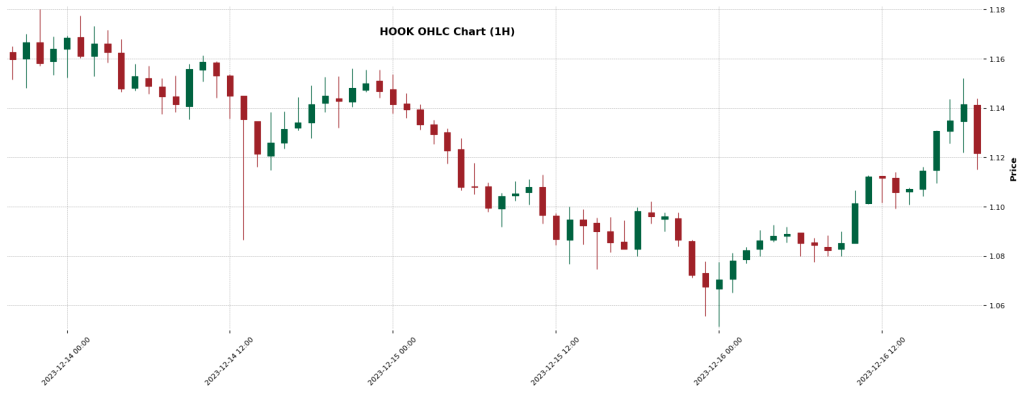

HOOK: Bullish Crossover with Moderate Backtesting

HOOK’s ‘EMA: Bullish Crossover’ suggests an uptrend. The token’s profit potential stands at $2.12, supported by a backtest success rate of 53.57% and a profit potential of 2.74%. These figures indicate a moderately positive outlook for HOOK, warranting attention from traders.

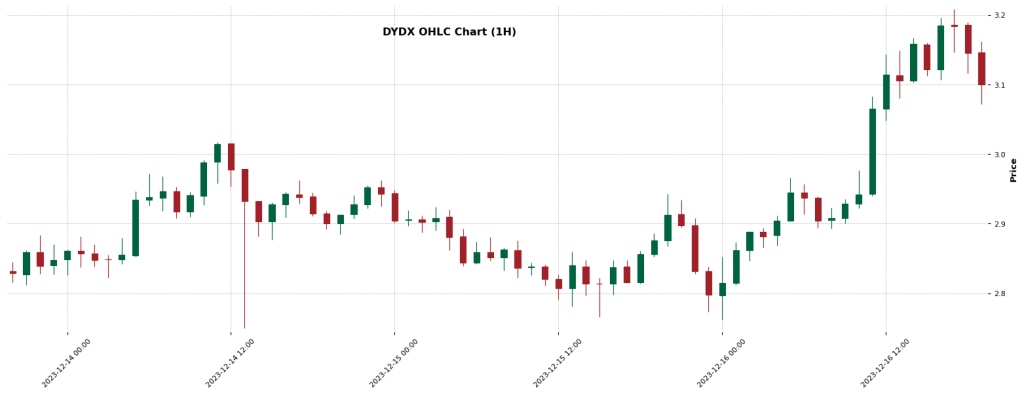

DYDX: Overbought Condition with Strong Backtesting

DYDX shows an ‘RSI: Overbought’ signal, but unlike typical overbought scenarios, its backtesting data is quite positive, with a success rate of 54.5% and a profit potential of 9%. With current support at $2.84 and resistance at $3.35, DYDX’s profit potential of 6%0912635683 suggests a cautiously optimistic approach.

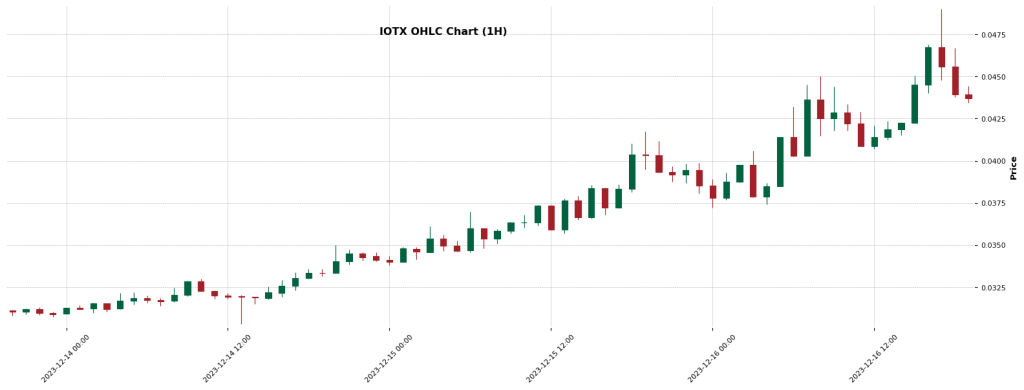

IOTX: High-Profit Potential in Overbought Territory

IOTX has signaled an ‘RSI: Overbought,’ yet offers a striking profit potential of $12.03. This is reinforced by backtesting data showing a 57.61% success rate and a profit potential of $17.86, making it an intriguing token for traders despite the overbought status.

ELF: Bearish Crossover Signals Caution

ELF’s ‘EMA: Bearish Crossover’ is a cautionary signal for potential downward movement. With a profit potential of 1.9% and support at $0.79 versus resistance at 0.83%, ELF warrants close observation, especially in the absence of matching backtest data.

For more chart patterns, trading signals, and crypto data, download our app in the Appstore or Playstore: Download Now

In conclusion, each of these tokens presents a unique set of opportunities and challenges based on their latest trading signals. Understanding these signals, coupled with thorough market analysis, is key to developing effective trading strategies.

For traders seeking to navigate these complexities, our platform, CryptoKnowledge, offers comprehensive tools and insights, including free chart pattern recognition, to aid in making informed trading decisions in the dynamic world of cryptocurrency.