Although we’re still in the middle of a bear market, LINK, the native cryptocurrency of Chainlink, seems to stand out as a beacon of potential and resilience.

As a dedicated trader in the crypto space, I’m thrilled to unveil my analysis of LINK. This token shows signs of robust growth and offers investors a glimmer of optimism in these turbulent times.

The Current Landscape of LINK

Recent Price Surge

Embarking on a journey at a recent price of $7.413, LINK has marked a triumphant upward swing, soaring by a remarkable 23.94% over the past month.

The crypto world watched in anticipation as LINK faltered slightly last year, marking a decline of 6.70%.

However, the 7-day growth of 8.28% signals a promising recovery and an encouraging indicator of a sustained bullish outlook. The crypto community is abuzz with discussions about LINK’s steadfast rebound, and many are joining the movement to rally behind this rising star in the crypto realm.

Moreover, as the chart below shows, LINK is on its way to breaking out of a long-sideway trend.

Chainlink (LINK) — Delving into Comprehensive Trend Data

EMA and SMA Trend Lines

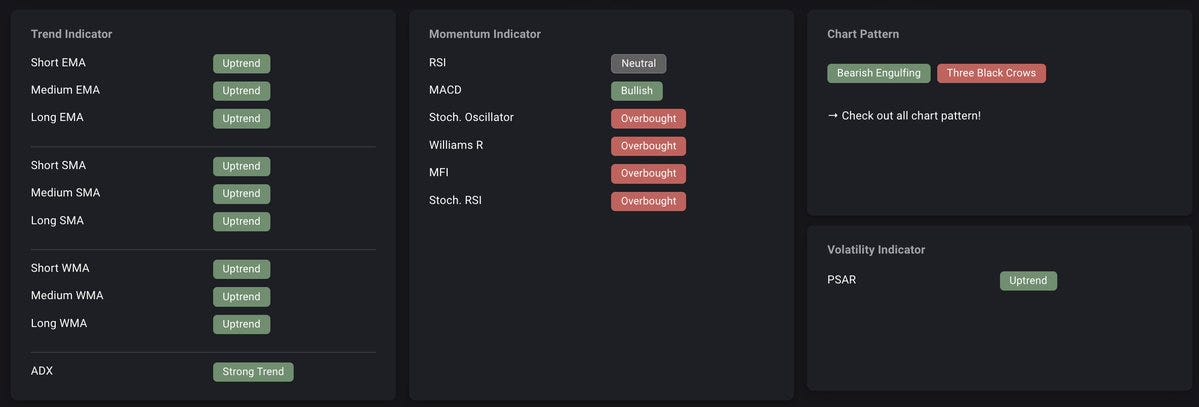

A close examination of the comprehensive trend data highlights the unmistakable uptrend in the short, medium, and long-term period across both EMA (Exponential Moving Average) and SMA (Simple Moving Average) trend lines. This consistent upward trajectory across varied timeframes offers investors confidence and assurance in LINK’s robust performance and potential for continued growth.

ADX Indicators

The ADX (Average Directional Index) accentuates the strength of LINK’s ongoing uptrend, solidifying the momentum and reinforcing the potential for sustained upward price movements. These encouraging technical indicators bolster the case for LINK as a promising and lucrative investment opportunity.

Momentum Analysis

Bullish MACD

In the momentum spectrum, the MACD (Moving Average Convergence Divergence) is decidedly bullish, signaling a prevailing momentum with buyers significantly outweighing sellers. This momentum underscores the potential for LINK’s continued upward trajectory, further enhancing its appeal as an investment choice.

Overbought Scenarios: A Closer Look

While multiple indicators such as the Stochastic Oscillator, Williams R, MFI (Money Flow Index), and Stochastic RSI are flagging an overbought scenario, it’s crucial to approach this with a balanced perspective. Overbought conditions can persist in a strong uptrend, an overlooked phenomenon but essential to consider when analyzing LINK’s potential.

Neutral RSI: A Cushion Against Reversal Risk

The neutral RSI (Relative Strength Index) offers a buffer, safeguarding against immediate reversal risks. This stability, paired with the PSAR (Parabolic Stop and Reverse) volatility indicator that mirrors the bullish trend analysis, confirms the overall bullish outlook for LINK.

More about Chainlink (LINK)

→ September Spotlight on Chainlink: Analysis and Trade Recommendations

→ Bearish Pressure Pulls Chainlink to $5.38: Time to Sell or Time to HODL?

→ Bullish Outlook: Chainlink (LINK) Aims for 40% Gain

Conclusion: LINK as an Investment Magnet

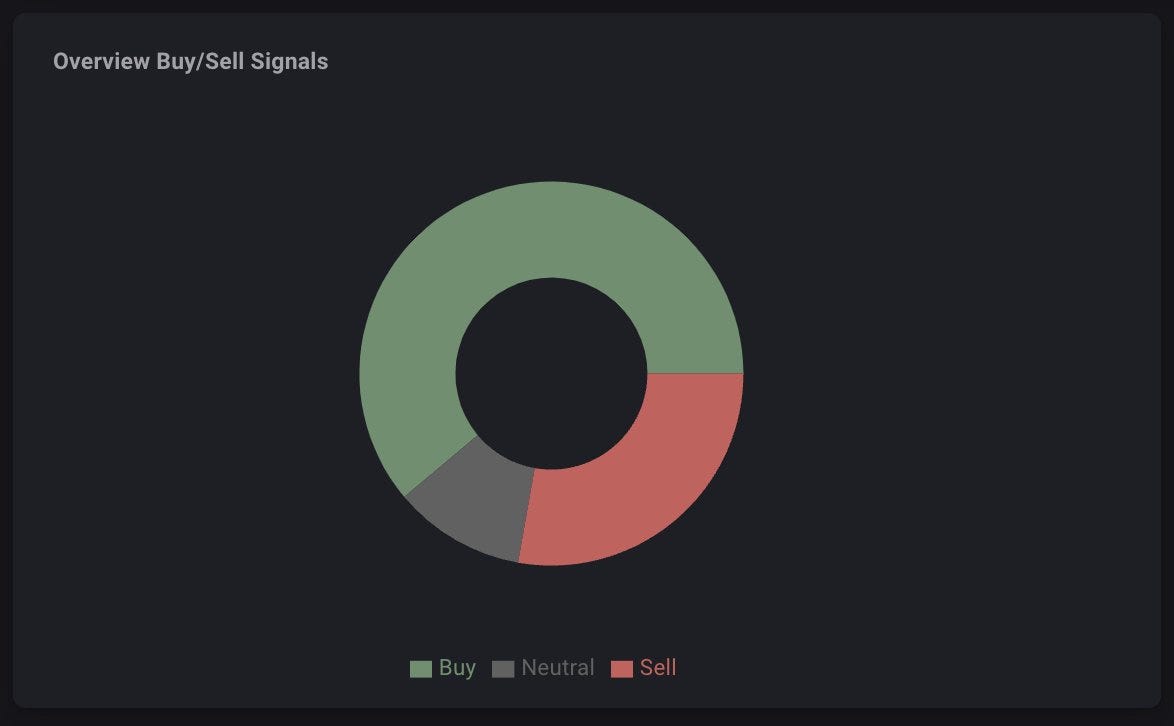

In the conclusion of this analysis, it’s evident that despite slightly overbought scenarios, the resolute bullish trend across different timescales proposed by EMA, SMA, and PSAR, coupled with a substantial price increase and a bullish MACD, positions LINK as a highly attractive short-term investment option.

The myriad of positive indicators underscores the potential for LINK’s sustained growth and its emerging status as a robust investment magnet.

Forward Path: Navigating the LINK Landscape

Continuous Monitoring and Risk Management

As we progress in the dynamic world of crypto trading, it’s imperative to continuously monitor these momentum indicators for any abrupt changes that could denote a possible shift in price dynamics.

Implementing appropriate risk management strategies is paramount when trading in this volatile asset class, ensuring preparedness for any fluctuations in the market landscape.

Embracing LINK’s Potential

In embracing LINK’s potential, investors are poised to navigate the exhilarating terrain of cryptocurrency trading with confidence and insight. The compelling analysis of LINK’s performance, trend data, and momentum indicators illuminates the path forward, offering a clear and comprehensive guide for novice and seasoned investors.

In the grand panorama of cryptocurrency trading, LINK emerges as a beacon of potential, resilience, and growth. Join me in keeping a close watch on LINK’s trajectory as we collectively explore the opportunities and possibilities it unfurls in the vibrant world of crypto trading.

Your Next Step(s)

→ Check out the CryptoKnowledge Platform and enhance your trading skills

→ Start trading Chainklink (LINK)