Today, I’m excited to share with you an in-depth look at a crypto trading strategy that’s been making waves in the crypto trading space – the Hyper Scalper strategy. My role as a strategy analyst and passionate crypto enthusiast is to provide an unbiased yet thorough assessment of various trading methodologies.

In my journey of exploring and analyzing trading strategies, the Hyper Scalper stood out due to its unique combination of Exponential Moving Averages (EMAs) and the Average Directional Index (ADX). It promises a refined way to understand and act on the crypto market’s movements. On top of that, the strategy showed some impressive success rates exceeding 80%. But we will focus on that later.

Join me as we delve into the intricacies of the Hyper Scalper strategy, examine its performance in different market conditions, and discuss my balanced perspective on its practical application. This exploration is about equipping you with knowledge and insights into a strategy that has shown significant potential in the volatile world of crypto trading. Let’s embark on this insightful journey together and uncover the capabilities of the Hyper Scalper strategy in an ever-changing market landscape.

Understanding the Hyper Scalper Crypto Trading Strategy: A Beginner’s Guide

As someone passionate about crypto trading and keen on sharing knowledge, I find it crucial to explain the Hyper Scalper strategy in a way that’s accessible to those who are relatively new to this space. The Hyper Scalper is more than just a set of rules; it’s a strategic approach designed to navigate the complexities of the cryptocurrency market effectively.<

However, it is already worth mentioning that the Hyper Scalper represents a relatively simple trading strategy. As you will learn below, it just uses two different indicators. Therefore, it is probably a good strategy for new traders to get familiar with technical indicator trading.

Used Technical Indicators: The Core of the Hyper Scalper Strategy

At the heart of the Hyper Scalper strategy are several key components that work together to identify potential trading opportunities. These include:

- Exponential Moving Averages (EMAs): The strategy utilizes three EMAs – the EMA200, EMA100, and EMA25. The EMA200 indicates the long-term trend, the EMA100 provides a mid-term view, and the EMA25 responds quickly to recent price changes. These EMAs help understand the overall market trend and make informed decisions.

- Average Directional Index (ADX): This is a momentum indicator that measures the strength of a trend. An ADX reading above 30 is key to the Hyper Scalper strategy. It suggests a strong trend, giving more credibility to the trading signals generated.

How Signals are Generated

As already mentioned, the beauty of the Hyper Scalper strategy lies in its ability to generate clear ‘long’ and ‘short’ signals based on the position and movement of the EMAs and the ADX reading. Here’s a simple breakdown:

- Long Signal Generation: The price is above the EMA200, indicating a general uptrend. Moreover, EMA25 is above EMA100, and EMA100 is above EMA200, forming an uptrend pattern. On top of that, the ADX reading exceeds 30, confirming the trend’s strength. In this case, a signal is produced once the price crosses below EMA25 but stays above EMA100, then crosses back above EMA25 within five candles.

- Short Signal Generation: A short signal is generated when the price is below the EMA200, suggesting a downtrend. The EMAs should be in descending order (EMA25 below EMA100 and EMA100 below EMA. The ADX again exceeds 30, confirming the trend’s strength. However, in this case, the price crosses above the EMA25 stays below the EMA 100 and then crosses back below the EMA25 within five candles.

Find out more about crypto trading: Make Trading A Breeze — Discover The Crypto Trading Assistant!

Backtest Results

One of the most critical aspects of each trading strategy is in doing a proper backtest analysis. The below analyses are based on more than 180 crypto tokens and data from the last 1-5 years (depending on the token). Therefore, the results should be statistically relevant. Moreover, we clustered the analysis into bullish and bearish signals to provide a more detailed assessment.

Analyzing Daily Results: Insights from the Hyper Scalper Crypto Trading Strategy

In this section, I’ll share the intriguing results from applying the Hyper Scalper crypto trading strategy on a daily (1D) timeframe, showcasing its potential for traders looking to navigate long-term trades.

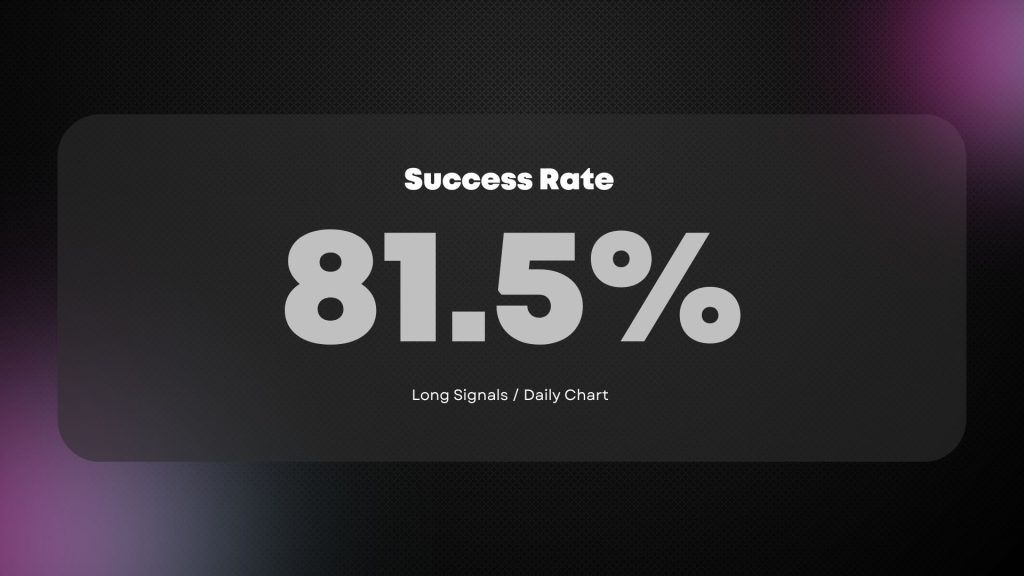

Overview of Daily Performance — Long Signals

The Hyper Scalper strategy revealed some compelling statistics when applied to daily charts. The strategy achieved an impressive average success rate of 81.51% for bullish signals. This high success rate indicates the strategy’s effectiveness in daily identifying upward trends and potential buy opportunities.

However, looking at “top-performing” and “worst-performing” tokens is interesting. Therefore, the table below contains the top 5 and flop 5 tokens for the Hyper Scalper crypto trading strategy on the daily chart. It is worth mentioning that we excluded tokens that have generated less than 5 signals in our backtests. As you can see, the strategy produces a set of tokens with a 100% success rate — which is extraordinary. Moreover, except for Fetch.ai, no token has a success rate below 70%.

Top Performing Crypto Tokens — (Long Signal / Daily Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| Ardor (ARDR) | 8 | 100% |

| Bitcoin Cash (BCH) | 5 | 100% |

| Bluezelle (BLZ) | 5 | 100% |

| Dogecoin (DOGE) | 5 | 100% |

| Injective Protocol (INJ) | 7 | 100% |

Worst Performing Crypto Tokens (Long Signal / Daily Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| Cortex (CTXC) | 24 | 75% |

| Convex Finance (CVX) | 33 | 72.7% |

| Cosmos (ATOM) | 18 | 72.2% |

| Voyager Token (VGX) | 41 | 70.7% |

| Fetch.ai (FET) | 5 | 60% |

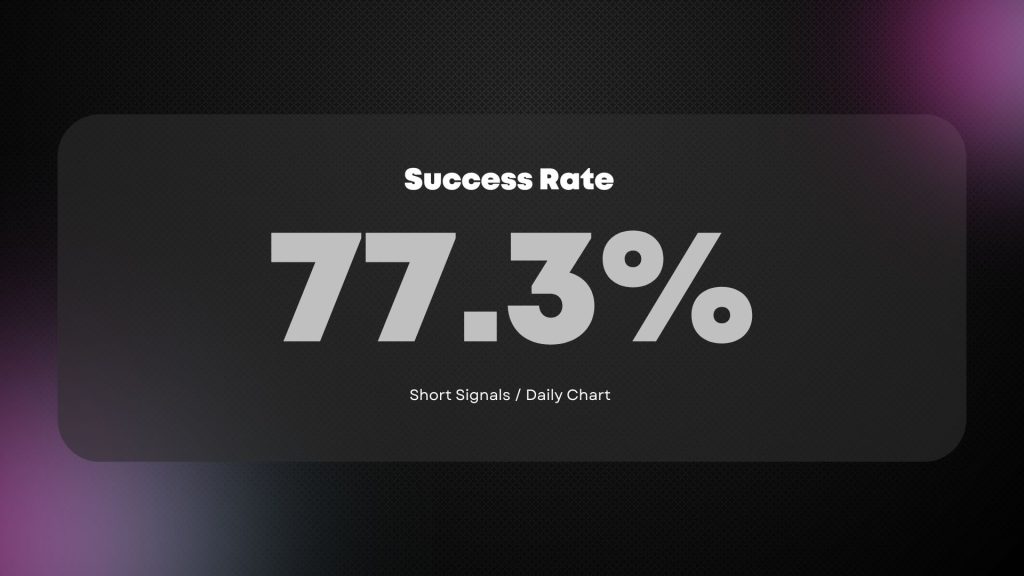

Overview of Daily Performance — Short Signals

The strategy also demonstrated notable effectiveness in bearish scenarios, with an average best probability of 77.32%. This highlights its adeptness not only in rising markets but also in identifying potential downtrends.

Top Performing Crypto Tokens (Short Signal / Daily Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| Pancake Swap (CAKE) | 5 | 100% |

| Decred (DCR) | 5 | 100% |

| DIA (DIA) | 5 | 100% |

| Komodo (KMD) | 8 | 100% |

| Reserve Rights (RSR) | 5 | 100% |

Worst Performing Crypto Tokens (Short Signal / Daily Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| NEM (XEM) | 5 | 80% |

| Voyager Token (VGX) | 22 | 77.3% |

| Cortes (CTXC) | 16 | 75% |

| Verge (XVG) | 7 | 71.4% |

| Cosmos (ATOM) | 20 | 65% |

My Take on the Daily Results

These daily results are particularly insightful for traders focusing on long-term market movements. The high success rates for both bullish and bearish signals reflect the robustness of the Hyper Scalper strategy in different market dynamics. However, it’s important to remember that while these numbers are promising, they are not guarantees. Market conditions can change rapidly, and what works well one day may not be as effective the next.

These results offer beginners a glimpse into the potential of disciplined and strategic trading. It’s about understanding the market’s rhythm and using tools like the Hyper Scalper to make more informed decisions. As you embark on your trading journey, consider these findings as a piece of the giant puzzle in mastering the art of cryptocurrency trading.

Delving into Hourly Results: The Hyper Scalper Trading Strategy in Action

For those who are relatively new to cryptocurrency trading and are curious about the intricacies of short-term market movements, analyzing the Hyper Scalper strategy on an hourly (1H) timeframe offers valuable insights. This section will focus on the performance of this strategy when applied to hourly charts, highlighting its potential for traders who prefer to operate on a shorter time scale.

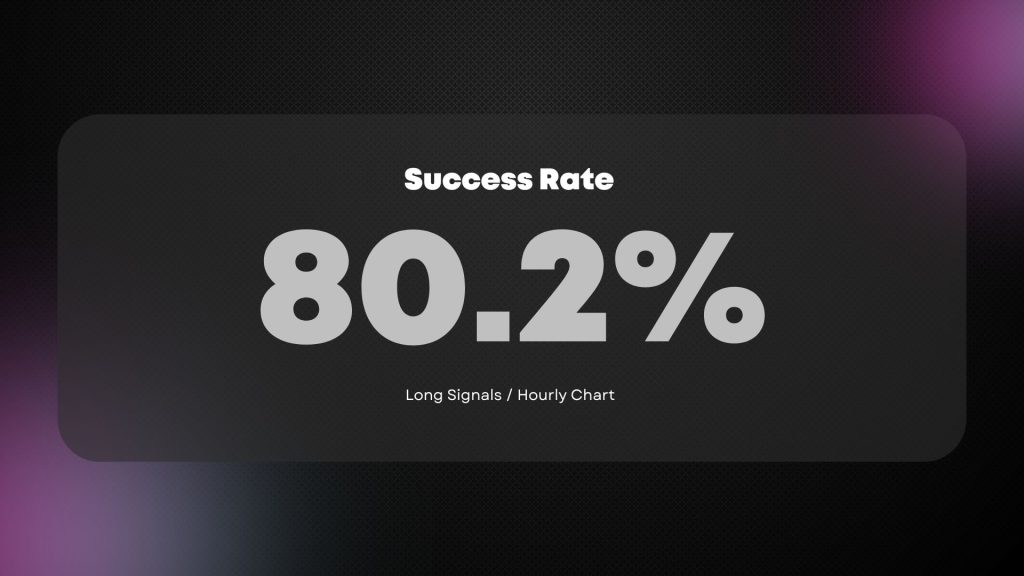

Overview of Hourly Performance — Long Signals

When we shift our focus to the hourly chart, the hyper-scalper crypto trading strategy continues to demonstrate its effectiveness. It achieved an impressive average best probability of 80.22% for bullish signals. This high probability indicates the strategy’s proficiency in capturing quick market movements and identifying potential entry points hourly.

Top Performing Crypto Tokens — (Long Signal / Hourly Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| Dusk (DUSK) | 14 | 100% |

| Icon (ICX) | 5 | 100% |

| Pepe (PEPE) | 7 | 100% |

| Storm (STORM) | 6 | 100% |

| Ethereum (ETH) | 20 | 95% |

Worst Performing Crypto Tokens (Long Signal / Hourly Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| NanoByte Token (NBT) | 11 | 63.6% |

| Reserve Rights (RSR) | 19 | 63.1% |

| Alchemix (ALCX) | 37 | 62.1% |

| Phantom (FTM) | 13 | 61.5% |

| Badger DAO (BADGER) | 28 | 60.7% |

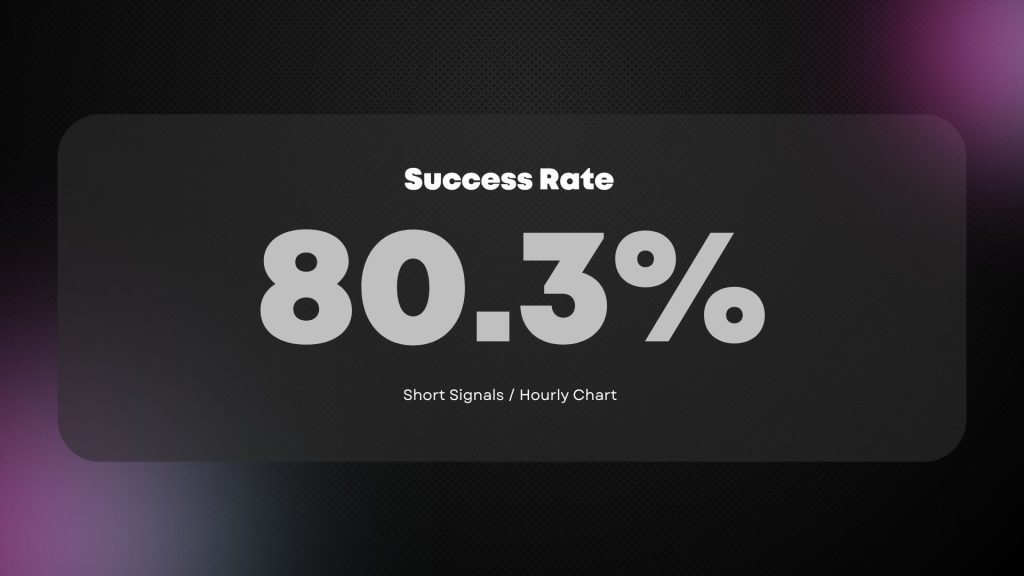

Overview of Hourly Performance — Short Signals

The strategy also showed a high average best probability of 80.3% on the hourly chart for bearish signals, indicating its ability to identify potential downtrends within this shorter timeframe effectively.

Top Performing Crypto Tokens (Short Signal / Hourly Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| Anchor Protocol (ANC) | 5 | 100% |

| AirSwap (AST) | 7 | 100% |

| Beta Finance (BETA) | 13 | 100% |

| Decred (DCR) | 13 | 100% |

| Dego Finance (DEGO) | 14 | 100% |

Worst Performing Crypto Tokens (Short Signal / Hourly Chart)

| Crypto Token | # Backtest Signals | Success Rate |

|---|---|---|

| ZCash (ZEC) | 29 | 65.5% |

| Ocean Protocol (OCEAN) | 29 | 62.1% |

| 1Inch (1INCH) | 34 | 61.8% |

| Augur (REP) | 5 | 60% |

| Pepe (PEPE) | 31 | 58.1% |

Interpreting the Hourly Results

These hourly results are particularly enlightening for traders who thrive on the fast-paced nature of the crypto market. The high success rates in bullish and bearish contexts underscore the Hyper Scalper strategy’s adaptability and precision over shorter periods.

These findings demonstrate the importance of being agile and responsive to market changes for beginners in the trading field. While the hourly chart can offer quick gains, it requires a keen eye and swift decision-making. It’s essential to remember that trading on such short intervals can be more volatile and risk-prone.

In summary, the hourly analysis of the Hyper Scalper strategy provides a fascinating perspective on short-term trading. It’s a testament to the strategy’s capability to navigate the rapid shifts of the cryptocurrency market and offers a valuable tool for those looking to engage in more frequent trades. As with any trading approach, balance and caution are key, especially when dealing with the inherently volatile nature of cryptocurrencies.

Navigating the Crypto Trading Landscape with the Hyper Scalper Strategy

As we conclude this exploration of the Hyper Scalper strategy, we must step back and view the findings through a holistic lens. With impressive success rates exceeding 80% in daily and hourly timeframes, this strategy has proven to be a valuable tool in any trader’s arsenal, particularly those new to the crypto trading world.

Key Takeaways from the Analysis

- Simplicity and Effectiveness: The Hyper Scalper’s reliance on a straightforward set of indicators (EMAs and ADX) makes it an accessible strategy for beginners, yet its effectiveness in identifying trading opportunities is on par with more complex systems.

- Adaptability: One of the most striking aspects of this strategy is its adaptability across different timeframes. The consistency in performance, whether on a daily or hourly chart, is a testament to its robustness in various market conditions.

A Balanced Perspective

While the success rates and top-performing tokens paint a promising picture, it’s crucial to maintain a balanced perspective. The world of crypto trading is dynamic and often unpredictable. Strategies that perform exceptionally well under certain conditions may face challenges as market dynamics evolve. Thus, traders should not solely rely on one strategy but use it as part of a diversified approach.

Guidance for New Traders

For newcomers to crypto trading:

- Education and Caution: Emphasize the importance of understanding the underlying mechanics of any strategy and approach trading with caution and awareness of the risks involved.

- Continuous Learning: Encourage ongoing learning and adaptation. The crypto market is ever-changing, and staying informed is key to success.

Empowering Your Trading Journey

In summary, the Hyper Scalper strategy is a compelling option for those venturing into crypto trading. Its blend of simplicity, effectiveness, and adaptability makes it an excellent starting point for beginners, providing them with a solid foundation to develop their trading skills.

However, remember that no strategy is infallible in the volatile world of cryptocurrencies. Continuous learning, risk management, and a balanced approach are vital to navigating this exciting yet challenging landscape. As you embark on or continue your trading journey, may the insights from the Hyper Scalper strategy serve as a guiding light, illuminating your path towards informed and strategic trading decisions.

About CryptoKnowledge

At CryptoKnowledge, we pride ourselves on providing top-notch crypto data and tools. Our app is accessible on both the App Store and Play Store, featuring an array of functionalities like crypto signals, screeners, AI-based forecasts, and much more. Discover how we can elevate your trading experience, and download the app now!