Ever stumbled upon a hotly discussed strategy on the internet and thought, “What’s all the fuss about?” That’s precisely how I felt when I first came across the buzz surrounding the Parabolic Trader strategy. With so many traders and enthusiasts passionately discussing its potential, I knew there was something unique about it. My innate curiosity led me on a mission: to dissect this strategy and lay it out, piece by piece, for everyone to grasp.

This article aims to unravel the Parabolic Trader strategy, from the intricacies of the indicators used to the specifics of each signal. And because knowing is just half the battle, I’ll also guide you on maximizing this strategy’s potential with the advanced tools CryptoKnowledge provides.

Dive in, and let’s demystify this together!

Demystifying a 70% Win Rate Strategy: How Does It Work?

The essence of the Parabolic Trader lies in its unique combination of three vital indicators: the Parabolic SAR (PSAR), the Exponential Moving Average (EMA 200), and the Moving Average Convergence Divergence (MACD). When utilized cohesively, these indicators provide compelling insights into potential trading opportunities.

Spotlight on the Indicators

- Parabolic SAR (PSAR): Think of PSAR as your personal guide in detecting a token’s momentum shift. Its main function is determining which way the market is moving and highlighting potential reversal points.

- Exponential Moving Average (EMA 200): EMA200 is like the pulse-check of the market. It focuses on the most recent price data, helping traders identify the market’s overarching trend. When prices are above EMA200, it often signals a bullish market, and vice-versa.

- Moving Average Convergence Divergence (MACD): Acting as the bridge between two EMAs of a token’s price, MACD is a dynamic indicator that discerns potential buy and sell opportunities. It’s all about understanding the relationship and divergence between these EMAs.

The Signal Triggers

Alright, now that we’ve understood the indicators used in the strategy, it is essential to look at the triggers. Trigger in this context means that the indicators have to have a certain value or state in order to indicate a buy or sell potential.

Long/Bullish Conditions

A buy signal is triggered when the three indicators show the following state:

- The token’s closing price is above EMA200.

- Token’s closing price soars above the PSAR.

- MACD showcases a bullish crossover, where the line crosses above the signal line.

In this context it is very important that all indicators criteria are met before entering a trade.

Shor/Bearish Conditions

Conversely, a sell signal is triggered when the three indicators show the following status:

- Token’s closing price resides below EMA200.

- Token’s closing price dips below the PSAR.

- MACD exhibits a bearish crossover, with the line crossing below the signal line.

Backtest Results Show 70% Success Rate

The Parabolic Trader strategy shone brightly in thorough backtests with a laudable 70% success rate. Still, as every seasoned trader knows, past performance isn’t a crystal ball. It’s crucial to blend this strategy with a comprehensive market analysis.

How To Make The Most Out Of The Parabolic Trader

Now, the real magic happens when you combine the prowess of the Parabolic Trader strategy with the innovative features of CryptoKnowledge.

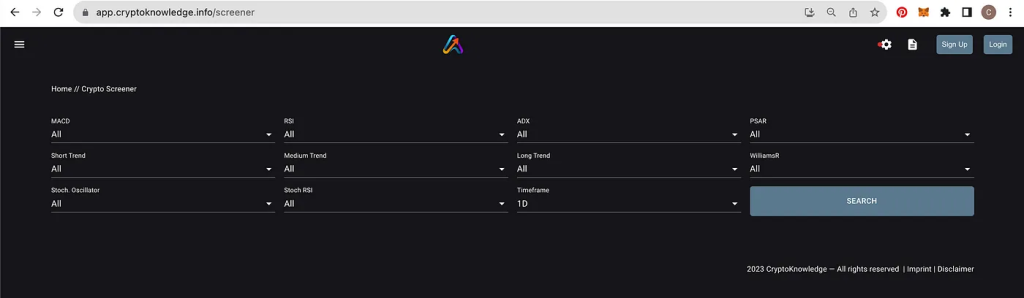

With CryptoKnowledge, you can seamlessly set up alerts based on the Parabolic Trader or any other strategy that resonates with you. Choose from 8 different indicators and set up alerts for more than 160 tokens. Picture this: Whenever a signal based on your chosen strategy is detected, an email notification flies to you, ensuring you never miss a golden trading opportunity.

The Takeaway?

Trading successfully is no longer about constant manual monitoring. Embrace the power of automated alerts, sit back, and make your moves whenever the market conditions align with your strategy. With CryptoKnowledge, trading becomes a harmonious blend of strategy and technology, making every trade decision more informed and strategic.

After all, in the dynamic world of crypto trading, being timely and strategic can make all the difference. Ready to elevate your trading game? Dive into the world of CryptoKnowledge and redefine your trading journey.

Disclaimer: The success rate mentioned is based on historical backtests of the Parabolic Trader strategy. It’s important to understand that past performance is not indicative of future results. Trading cryptocurrencies and other financial instruments carries risks, and no strategy can guarantee profits in every scenario. Always conduct thorough research and consider seeking advice from financial professionals before making any investment decisions.