NEO: Current Status – A Sleeping Giant Stirs?

The Chinese blockchain giant, NEO, is trading at a modest $7.83, down 1.07% in the past 24 hours. Some might be worried by the negative turn, but the savvy investor understands that fortunes can change rapidly in the volatile crypto market. After all, it’s not the first time that NEO has tested the waters of the bear market.

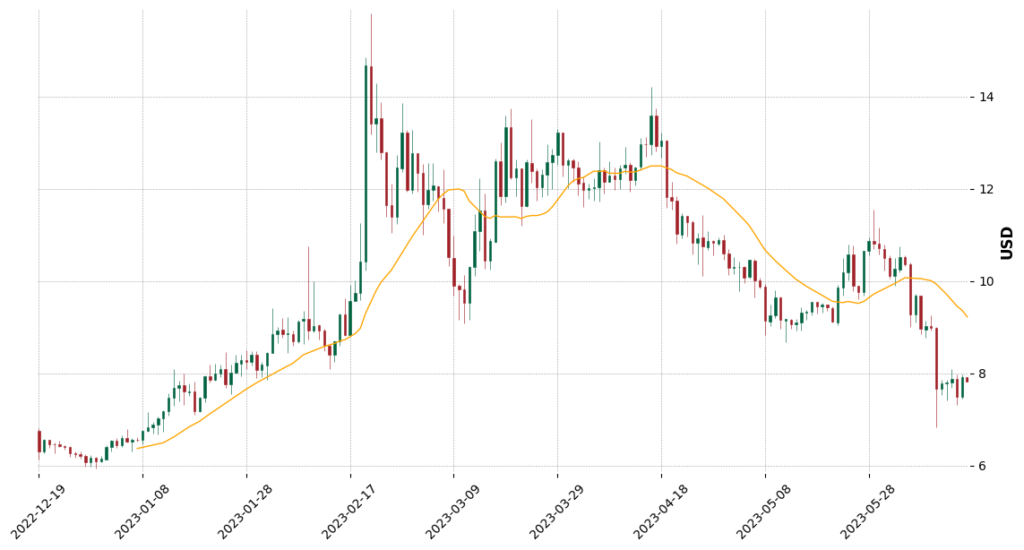

A bearish breakout from a Descending Triangle pattern, traditionally a bearish signal, pushed NEO below the $9.00 mark. The bearish trend has undoubtedly been evident, but the future might not be so bleak. NEO’s price has steadied around $7.50, and an uptick in bullish momentum (evidenced by a rising MACD Histogram) might see a short-term bounce toward the $9.00 mark.

The nearest Support Zones for NEO are $7.50 and $6.00, providing possible lower bounds for traders to watch. Conversely, the closest Resistance Zones are $9.00, followed by $12.00 and $15.00, offering potential price targets for those bullish on NEO’s future.

NEO — Technical Indicators

Trends based on the moving average indicate a Short, Medium, and Long Term Downtrend. This would typically signal traders to exercise caution, but the downtrends may also present buying opportunities at lower prices for those bullish on NEO’s long-term prospects.

The Relative Strength Index (RSI), an indicator used to identify overbought or oversold conditions, currently sits in neutral territory. This suggests that the asset is neither overbought nor oversold, making it challenging to discern precise buying or selling signals from this metric alone.

Contrary to the moving averages, the Moving Average Convergence Divergence (MACD), a trend-following momentum indicator, shows bullish signs. This could indicate an upcoming positive price momentum, reinforcing the notion of a possible short-term bounce.

Similarly, the oscillator provides a bullish signal. Oscillators can help identify turning points by indicating whether an asset is overbought or oversold.

Finally, the ADX (Average Directional Index) is weak, showing that the current trend strength is feeble. This could signify a potential reversal or sideways movement.

NEO — Trade Setup & Outlook

Considering the Descending Triangle breakout and downtrend confirmed by the SMAs, NEO seems to be bearishly oriented in the medium to long term. However, a rising MACD Histogram and a bullish Oscillator suggest a positive momentum inflection in the short time.

The immediate outlook presents a possible bounce back to the $9.00 Resistance Zone, particularly if the bullish momentum continues and volume increases. However, traders should exercise caution and set price alerts due to the generally bearish trends indicated by the moving averages.

About NEO – The Chinese Ethereum

NEO, often dubbed the “Chinese Ethereum,” is a blockchain platform and cryptocurrency designed to build a scalable network of decentralized applications. The base asset of the NEO blockchain is the non-divisible NEO token which generates GAS tokens used to pay for transaction fees generated by applications on the network. NEO supports various commonly used programming languages through a customized version of Docker called NeoVM, which compiles the code into a secure executable environment.

CHAPTER 5: Summary – Will the Phoenix Rise from the Ashes?

Despite a bearish breakout from a Descending Triangle and an overall downtrend for NEO, the token’s immediate future might not be as grim as it seems. The price stabilizing around the $7.50 mark and a rising MACD histogram suggest a possible momentum shift, indicating a potential short-term bounce towards the $9.00 Resistance Zone.

However, with the SMA trends and a neutral RSI pointing towards uncertainty, investors must approach cautiously. A weak ADX implies the trend strength is not robust, signaling the possibility for a reversal or sideways movement. Despite these warning signs, bullish signals from the MACD and Oscillator provide a silver lining for NEO enthusiasts.

In the larger picture, NEO’s standing as a significant player in the blockchain space, frequently compared to Ethereum and renowned for its scalable network of decentralized applications, should not be overlooked. The potential for growth and the current market conditions could present a lucrative opportunity for investors with a keen eye for market dynamics and a stomach for risk.

Whether NEO will rise like a phoenix from its current status, or continue in its descent, will depend on various factors, including market sentiment, technical indicators, and broader market trends. As always, potential investors are advised to do their own research and keep up-to-date with the latest market news. In the world of crypto trading, knowledge is, indeed, power.