The MACD (Moving Average Convergence/Divergence) is a popular tool used by traders to identify potential buy and sell signals. It helps in determining the momentum and direction of an asset’s price.

What is the MACD?

The MACD is a momentum indicator that shows the relationship between two price averages, helping traders identify changes in market direction.

How Does It Work?

The indicator is made up of two lines:

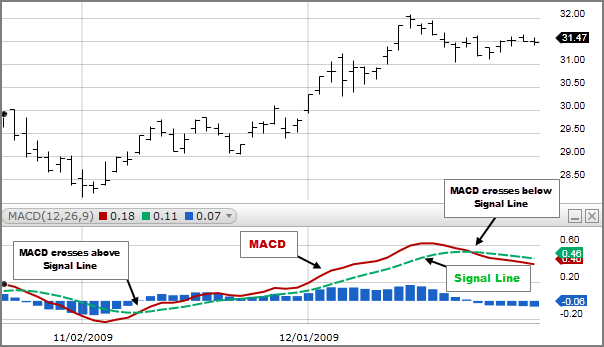

- MACD Line: This line is the difference between two Exponential Moving Averages (EMAs) of a security’s price. Typically, it’s calculated by subtracting the 26-day EMA from the 12-day EMA.

- Signal Line: This is the 9-day EMA of the MACD line. When the MACD line crosses above the signal line, it might be a good time to buy. Conversely, when the MACD line crosses below the signal line, it might be a signal to sell.

What Are Exponential Moving Averages (EMAs)?

EMAs are a type of average that gives more importance to recent prices. This makes them respond quicker to recent price changes. In the MACD:

- The 12-day EMA reacts to price changes over roughly the last 12 days.

- The 26-day EMA is slower, considering price changes over approximately the last 26 days.

By comparing these two averages, traders can get a sense of the direction and strength of a price trend.

Why is the MACD Important?

The MACD can help traders:

- Spot potential reversals in the market.

- Identify potential buy or sell opportunities based on where the MACD line is in relation to the signal line.

- Understand if an asset might be overbought (too many people have bought) or oversold (too many people have sold).

Conclusion

The MACD is a versatile tool in a trader’s arsenal. It’s not just a theoretical concept; it has practical implications in the real-world trading environment.

Consider a hypothetical situation: A trader observes that the line for a particular cryptocurrency is about to cross above the signal line. This could be an indication that the cryptocurrency is gaining momentum. Acting on this, the trader might decide to buy, anticipating a rise in price. Conversely, if the MACD line were to cross below the signal line, it might be a cue to sell, expecting a potential price drop.

Why Do Traders Rely on MACD?

- Directional Insight: It can provide clues about the overall direction of the market, be it bullish (upward) or bearish (downward).

- Momentum Confirmation: Before making a trade, traders want confirmation. If other indicators align with the MACD’s signal, it boosts their confidence in making a move.

- Spotting Overbought or Oversold Conditions: If the indicator shows extreme readings, it might indicate that an asset is overbought or oversold, which can precede a market reversal.

While the MACD is powerful, no indicator is foolproof. It’s always recommended to use it in conjunction with other tools and to have a clear risk management strategy.

For those new to trading, understanding tools like the MACD can be the difference between making informed decisions and trading blindly. As with all things, practice and experience will refine your skills and intuition over time.

Trade Confidently with CryptoKnowledge

Equipped with the knowledge you’ve just gained about the MACD, you’re now prepared to interpret the next signal that appears on our CryptoKnowledge platform. Our goal is to empower traders like you with the insights and tools needed to navigate the complex world of cryptocurrency trading. We believe that understanding foundational concepts like the MACD can greatly enhance your trading decisions.

Remember, every signal, every chart, and every piece of data you encounter is a piece of the trading puzzle. And while no single tool can guarantee success, having a robust knowledge base can significantly tilt the odds in your favor.

We hope this article has been instrumental in enhancing your trading knowledge. Here’s to your next trade being a resounding success with CryptoKnowledge!