Maker’s (MKR) daily chart has recently flashed some bearish signals. This blog post provides a detailed status of the crypto token and a potential trade setup based on our technical analysis.

Analyzing the Maker: MKR’s Current Market Status

As we traverse the uncertain terrain of the crypto market, Maker (MKR), an intriguing token, trades at $60. The price has registered a modest change of 1.4% in the last 24 hours. But a wider perspective unveils a 10% loss the token has suffered over the last few days.

The most crucial observation currently is MKR teetering on the brink of falling below the 200-day simple moving average (SMA), a pivotal market indicator. The breach of this level could potentially shift the dynamics of the MKR market.

Maker (MKR) — Technical Indicators

Understanding MKR’s market movement requires a deep dive into various technical indicators.

The trends based on the moving average suggest a Short Term and Medium Term Downtrend, with a Long Term Uptrend. This hints at a potential tug-of-war between the bears and bulls in the long-term scenario. However, as we already mentioned, watching how long the long-term moving average will stay bullish will be essential.

The Relative Strength Index (RSI), an indicator used to identify overbought or oversold conditions, currently sits in neutral territory for MKR. This implies a fair equilibrium between buying and selling pressures.

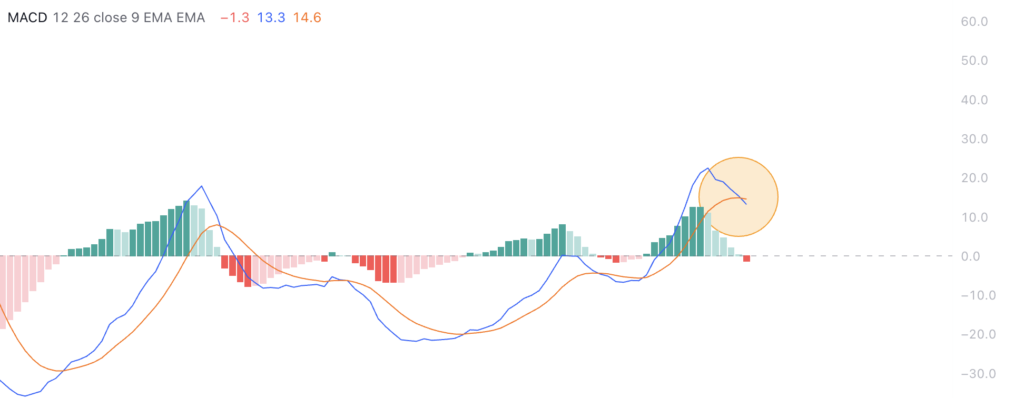

The Moving Average Convergence Divergence (MACD), a momentum-based indicator, flashes a bearish signal. This is usually a strong sign for the next price movements, especially on the daily chart.

Lastly, the Average Directional Index (ADX), an indicator that measures the strength of a trend, is showing strong signs. This indicates a strong trend in place, underpinning the potential for further price decline.

Maker (MKR) — Trade Setup & Outlook

With the MACD showcasing a bearish crossover on the daily chart, it paints a grim picture for MKR. Considering the recent downtrend and the MACD’s bearish signal, a further 10% decline and a re-test of the $620 resistance level could be in the cards.

Currently, MKR is hovering above the 200-day MA, a crucial level to watch out for. If it breaks to the downside, coupled with the bearish MACD crossover, a potential short trade could be a promising option for traders.

MKR’s Possible Descent or Rebound

In conclusion, MKR finds itself at a critical juncture, either succumbing to the bearish indicators and falling below the 200-day SMA or staging a surprising rebound. As the MACD projects a bearish outlook and MKR is perilously close to breaching the 200-day SMA, a potential short trade might be on the horizon. However renowned for its volatility, the crypto landscape can often defy expectations. It’s advisable to watch these crucial technical indicators and market patterns closely. In this high-stakes game, keeping abreast of the latest developments is paramount. Stay tuned as the MKR saga unfolds.

About Maker (MKR)

Maker (MKR) is a governance token on the MakerDAO platform, which oversees DAI. This stablecoin aims to keep its value as close to one United States dollar (USD) as possible through an automated smart contracts system on the Ethereum blockchain. MKR tokens act as a regulatory tool, and their holders are entitled to vote on various factors.

The article is for information purposes only. We are not liable for the correctness. The article does not give trading advice in any way.