It’s a new week and time for further cryptocurrency analysis. Today’s analysis focuses on Filecoin (FIL). As always, we dissect the most essential technical indicators, provide a detailed analysis, and derive a trade recommendation for the month ahead. The analysis is based on the daily chart.

So, let’s dive right into our Filecoin analysis!

Check out our latest article about Ethereum and Bitcoin

→ Ethereum’s September Analysis: Key Insights and Trade Recommendations

→ Bitcoin Price Update: Your Week-Ahead Outlook Unpacked!

Price Performance: A Year of Declines

Let’s start with a quick check of Filecoin’s price chart. Unsurprisingly, and similar to many other altcoins, the chart looks very depressive. Here are the details:

- Currently trading at $3.11, a minor decrease of 1.33% within the last 24 hours, FIL offers a spectrum of perspectives that might appeal to the discerning investor.

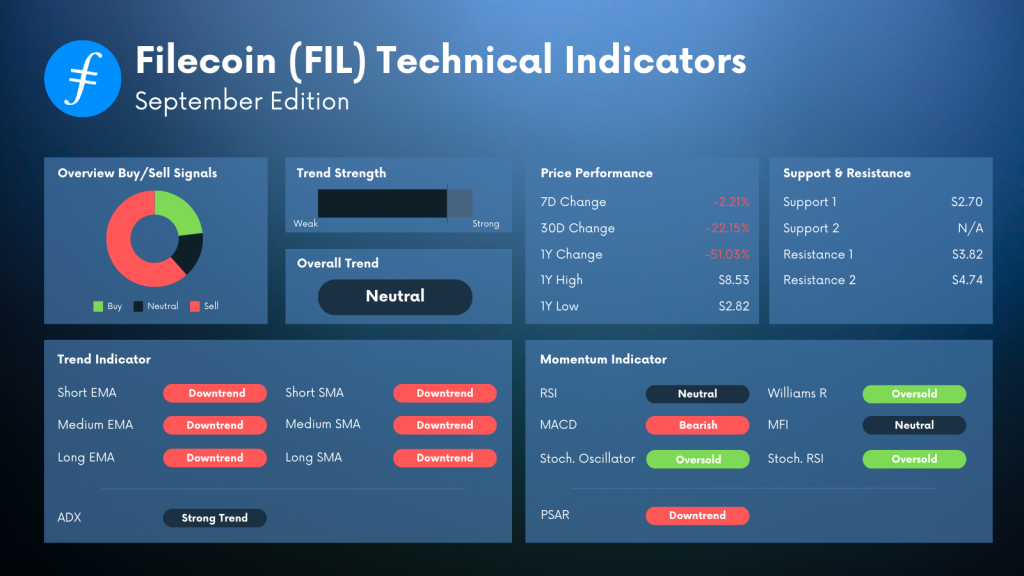

- Over the recent period, Filecoin has experienced a noticeable downturn in its price performance, and in the last week alone, it decreased by 2.21%.

- Last week’s loss contributed to a more significant monthly loss of 22.15%.

- Moreover, the year has been challenging for FIL, with a considerable negative change of 51.03%.

A retrospective look at the yearly price fluctuation reveals a high of $8.526 and a low of $2.815. These statistics underscore the token’s volatility and potentially indicate pivotal levels that might influence future market trends.

Filecoin’s Support & Resistance Levels: Key Areas to Watch

In the realm of support and resistance, Filecoin showcases significant levels that might serve as indicators for market behavior.

As you can easily spot in the above price chart, the primary and most crucial support stands firm at $2.70, offering a potential safety net for investors. This support line shouldn’t be broken by any means, as it would undoubtedly trigger a further downward spiral.

Meanwhile, the resistance levels are positioned at $3.82 and $5.20, representing critical thresholds that could influence a bullish reversal if successfully breached.

More about Filecoin (FIL)

→ Seizing the Moment: 6 Oversold Tokens That Could Turn Your Portfolio Around!

Filecoin Technical Indicator Analysis

Filecoin Trend Analysis: A Strong Downward Trend

Currently, Filecoin is embroiled in a strong downward trend, as reflected across several indicators.

All moving averages, the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) signal a downward trend. Moreover, this trend is reflected in all timeframes: The short-term, medium-term, and long-term timeframes. Therefore, Filecoin finds itself in a period of bearish market sentiment.

As it couldn’t get worse, the ADX reinforces the trend and highlights a strong trend. The Moving Average Convergence Divergence (MACD) continues to portray a bearish outlook, aligning with the current trend and suggesting that investors should tread cautiously.

Momentum Indicators: A Potential Turnaround

Since Trend Indicators can only rationalize the past, we look at momentum indicators and try to analyze if a turnaround is on the horizon. Here are our most essential findings.

Overall, it can said that despite the strong downward trend, the momentum indicators hint at potential upcoming changes:

- RSI & MFI: Both the Relative Strength Index (RSI) and the Money Flow Index (MFI) are in neutral territory, possibly indicating a period of market balance where buying and selling pressures are evenly matched.

- Oversold Indicators: Interestingly, the Stochastic Oscillator, Williams R, and Stochastic RSI showcase oversold conditions, potentially signaling an impending reversal or stabilization in the near future.

- PSAR: Echoing the sentiments of other indicators, the Parabolic SAR (PSAR) is currently in a downtrend, hinting at continued potential downward pressures.

Filecoin Analysis & September Forecast: A Pivotal Moment

As we venture further into September, Filecoin stands at a significant crossroads. While the prevailing trend indicates a downward trajectory, the oversold conditions present a flicker of optimism for a potential market correction or stabilization.

Investors looking to navigate the FIL market this month should approach with a calculated blend of caution and opportunism. The existing downtrend offers potential entry points for investors eyeing long-term gains but also warrants a vigilant approach to mitigate potential risks.

In conclusion, September may prove to be a decisive month for Filecoin, where a cautious yet hopeful strategy could be the linchpin in unlocking promising opportunities within the FIL market.

About Filecoin

Filecoin is a decentralized storage system that aims to “store humanity’s most important information.” It operates on a blockchain framework launched by Protocol Labs, allowing users to trade storage space in an open and competitive market.

The Filecoin network brings together buyers and sellers through its blockchain protocol, utilizing its native cryptocurrency, FIL, to facilitate transactions. Users who provide storage space earn FIL tokens, while users who want to utilize that space pay in FIL. This creates a decentralized market for data storage, shifting away from traditional centralized cloud storage providers. The project leverages cryptographic proofs to ensure files are stored correctly and securely, fostering a new era of open and efficient data storage solutions.

Your Next Step(s)

→ Check out the CryptoKnowledge Platform and enhance your trading skills

→ Start trading FIL