Venture into the realm of savvy crypto trading with our latest blog post. As you embark on this read, you’ll uncover the essence of “The Bold 10,” a weekly dispatch that promises to amplify your trading tactics. Peek behind the curtain of the top crypto picks and strategies shaping traders’ fortunes worldwide. Prepare to journey through a landscape where clarity meets opportunity, and each word you read equips you for the next market move. Ready for a glimpse into the future of trading? Let’s dive in.

BNB’s Strategic Surge: Decoding Its Market Success

BNB shines as a beacon for astute investors, backed by a suite of compelling market indicators and strategic market standing. Here’s a deeper dive into what makes BNB a top pick.

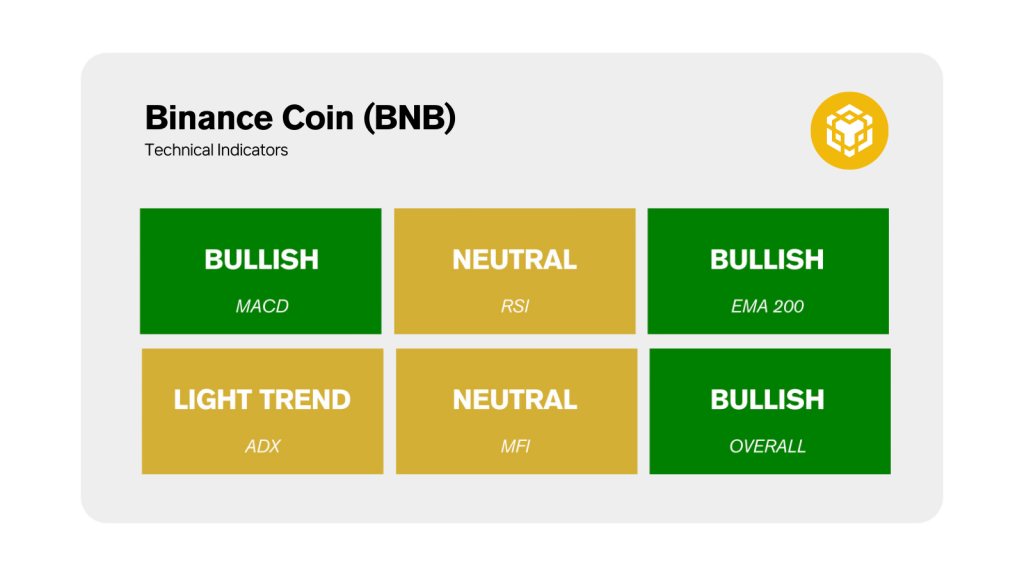

BNB’s Market Indicators: A Symphony of Strength

BNB’s performance is a dance of delicate balance and robust momentum. Its RSI, firmly planted in neutral territory, reflects a harmonious market, neither overbought nor oversold. The bullish MACD is a clarion call, signaling the potential for continued upward price movements.

The light trend indicated by ADX, coupled with a neutral Money Flow Index, paints a picture of a stable yet dynamic market thriving on balanced buying and selling pressures. Across timeframes, the uptrends in EMAs and SMAs reinforce a narrative of enduring positive sentiment, solidifying BNB’s place in a growth-oriented market.

Navigating BNB’s Price Landscape

Trading at $318.90 at the time of writing, BNB’s current market valuation is a testament to its resilience. The key resistance levels at $276.50 and $338.30 mark the gateways to potential further ascents, while support levels at $261.70 and $245.40 provide a safety net against downward fluctuations.

The Investment Case for BNB

With its strong technical indicators and expanding role in the Binance ecosystem, BNB is not just a promising investment; it’s a strategic one. It offers a blend of stability and growth potential, making it a compelling pick. For investors looking to capitalize on the burgeoning crypto market, BNB presents a balanced proposition of risk and reward.

About Binance

Binance Coin (BNB), initially launched as a utility token for the Binance cryptocurrency exchange, has rapidly evolved to become a central pillar in the broader crypto ecosystem. Originating with the primary function of reducing trading fees on the Binance platform, BNB’s scope has expanded dramatically, mirroring the growth trajectory of Binance itself, which has become one of the largest and most influential crypto exchanges globally.

Tellor (TRB): Primed for a Rally Post-Consolidation

After its remarkable rally from $67 to $260 in December 2023, TRB has demonstrated the volatile yet powerful potential that can capture the attention of any investor looking for significant moves.

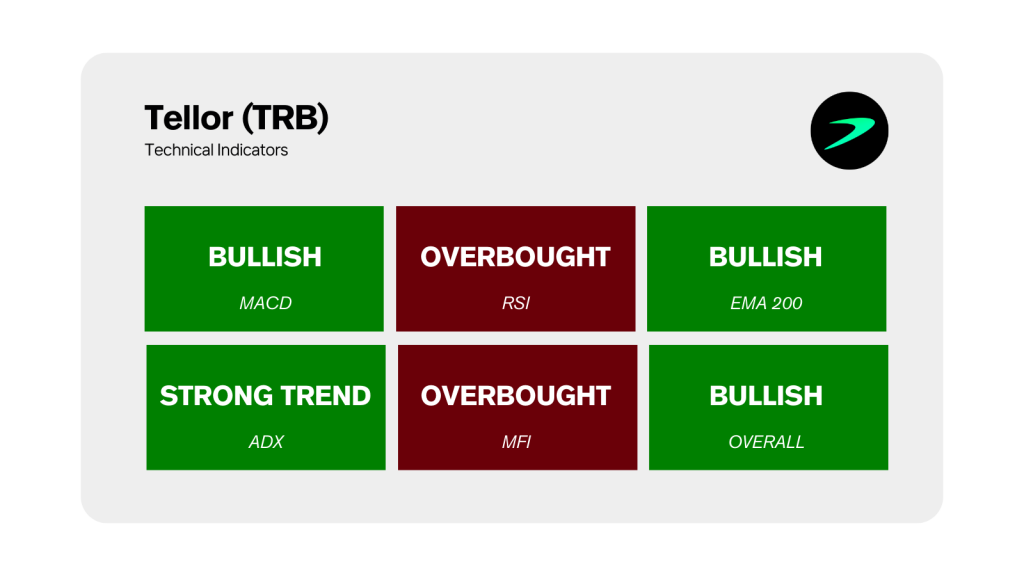

TRB’s Technical Indicators: Signaling Upward Momentum

- ADX (Strong Trend): Tellor’s ADX indicator reflects a strong trend, a compelling sign that its recent consolidation may be the precursor to a continued upward trajectory.

- MFI (Overbought): While currently overbought, this suggests that recent enthusiasm around TRB could lead to sustained interest if the market conditions remain favorable.

- Latest Price Dynamics: Currently at $183, TRB sits comfortably above its support level, showing resilience and potential for growth.

Navigating TRB’s Price Action: The Path of Potential

- Rally and Retrace: TRB’s rally in the last month speaks volumes about its potential. Although it has retraced from its peak, such movements are typical in crypto markets, often setting the stage for the next leg up.

- Resistance to Watch: The $260 mark represents a significant resistance point. A break above this level could indicate a robust continuation of its rally.

- Supporting Gains: With strong support at $140, TRB has a substantial foundation to build upon, offering a relatively secure position for investors to consider entering.

TRB’s Market Outlook: A Narrative of Growth

The story of Tellor is one of resilience and potential. Given its solid technical posture and the historical price action that saw it ascend sharply before entering a consolidation phase, TRB is a token that offers more than just a promise—it offers a clear opportunity. For investors attuned to the rhythms of the market, TRB presents a case of a token not merely bouncing back but also setting the stage for a continued rally.

Investing in TRB now could be akin to joining a journey mid-way that has already displayed its capacity for significant gains and is now gearing up for its next chapter of growth. With the market’s eyes set on its next move, TRB stands out as a token to watch and consider for those looking to capture dynamic price movements.

About Tellor (TRB)

Tellor entered the cryptocurrency sphere as a decentralized oracle solution, bridging the gap between off-chain data and on-chain demand. In the burgeoning blockchain world, where smart contracts live and breathe data, Tellor provides a critical service—offering a secure and reliable channel for feeding external, real-world information into the blockchain.

It is a decentralized provider of high-value data for smart contracts on Ethereum and other blockchains. By incentivizing a network of miners to provide data, Tellor ensures that the information is accurate, tamper-resistant, and up-to-date, which is vital for the execution of smart contracts that may govern anything from financial derivatives to insurance claims.

In essence, Tellor is not merely a project or a token; it’s a vital cog in the decentralized finance (DeFi) machinery, a testament to the innovative spirit of the crypto market. With its solid fundamentals and its vital role in the infrastructure of DeFi, Tellor is positioned to be a cornerstone in the ongoing evolution of blockchain technology.

XMR: A Deep Dive into Its Investment Potential

Monero (XMR) earns its spot with a unique blend of privacy-focused features and compelling technical signals that suggest a solid buy opportunity.

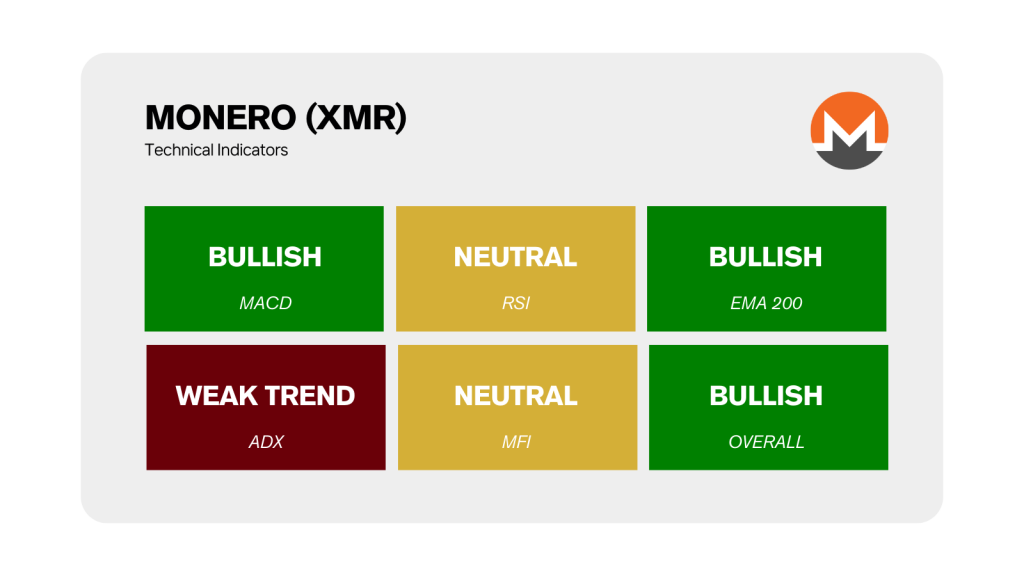

Indicator Breakdown: XMR’s Bullish Beckoning

- EMA & MACD: XMR’s Exponential Moving Averages maintain a bullish crossover, reinforced by a MACD that echoes this positive sentiment. Together, they indicate a momentum that may propel XMR beyond its current valuation.

- The RSI and MFT stand at a neutral juncture, signifying neither an overbought nor oversold condition, suggesting that the current price is stable and may be gearing up for the next move.

- A weak ADX points to a consolidating market, yet for XMR, this lull precedes what many analysts predict as a buildup to a stronger trend.

- At $173, XMR is currently trading above its most recent support level, with a resistance at $180.

Why XMR Stands Out for Investment

Despite a weak ADX, which might deter some, the savvy investor recognizes the consolidation phase as a prelude to breakout potential. Monero’s stability in price, coupled with its steady MFI, positions it as ripe for acquisition, especially when considering the likelihood of resistance levels turning into support in a bullish reversal.

Furthermore, XMR’s intrinsic value as a leading privacy coin gives it a distinct place in the crypto market, with fundamentals that support long-term holding. It is not just technicals that make XMR a buy; the underlying strength of its privacy-preserving proposition continues to attract investors.

About Monero

As a top privacy coin, Monero offers investors more than just a share in a cryptocurrency; it offers a stake in the digital privacy movement. This dual appeal of robust privacy features and favorable technical indicators makes XMR a standout asset in this week, presenting a not-to-be-missed buying signal for those looking to diversify with a coin that offers both stability and the promise of growth.