Unraveling the Truth About Scalping Crypto – Is the Power Scalper Strategy Your Golden Ticket?

Welcome to a revealing journey into the world of crypto scalping. Today, we’re not just scratching the surface; we’re diving deep into an exhaustive backtest analysis of the Power Scalper strategy, a method often touted as a fast track to success in the high-stakes game of short-term trading. Every new trader dreams of mastering scalping, lured by the promise of quick profits, and the Power Scalper strategy has emerged as a beacon of hope. But does it really live up to the hype?

In this comprehensive review, we’ll peel back the layers of the Power Scalper strategy, scrutinizing its performance through rigorous backtesting. Our mission is clear: to provide you with an unfiltered, data-driven perspective on whether this strategy is the go-to tool for your scalping aspirations.

By the end of this analysis, you’ll have a crystal-clear picture of the Power Scalper strategy’s true capabilities. We’re here to answer the burning question on every aspiring crypto scalper’s mind: Can the Power Scalper strategy reliably deliver on the promise of rapid gains in the volatile crypto market?

Join us as we navigate the intricate dynamics of crypto scalping, dissecting the Power Scalper strategy to reveal its potential and limitations. This isn’t just another overview; it’s a deep dive designed to equip you with essential insights, helping you decide if this strategy aligns with your journey toward scalping success in the world of cryptocurrency. Let’s cut through the speculation and delve into the facts, unveiling the reality of scalping with the Power Scalper strategy.

Strategy Details: What’s The Power Scalper Strategy?

Before we dive into our extensive backtest results, it’s crucial to delve into the core components of the Power Scalper strategy and understand the mechanics driving its performance. This strategy isn’t just a set of rules; it’s a carefully crafted system designed for the fast-paced nature of the crypto market, and our focus is to analyze its components through the lens of backtested data.

Scalping Crypto Tokens: The Key Indicators of the Power Scalper Strategy

The Power Scalper strategy harnesses the power of three critical indicators:

- Relative Strength Index (RSI): A cornerstone of many trading strategies, the RSI in the Power Scalper setup is crucial for identifying overbought (>70) and oversold (<30) conditions. Our backtest analysis scrutinizes how the RSI’s indications correlate with market movements and price reversals in short-term trading scenarios.

- SSL Indicator: A unique aspect of this strategy, the SSL determines the trend direction based on past price highs and lows. The backtest results offer insights into how the ssl_up and ssl_down values align with actual market trends, providing a clearer picture of the indicator’s reliability.

- Trend Direction Force Index: This index combines price, volume, and time to gauge the strength of price trends. Our analysis focuses on how effectively this indicator signals potential market reversals, a critical aspect for any trader looking to capitalize on short-term market movements.

Read more about crypto trading and signals: How to Effortlessly Receive Tailored Crypto Trade Signals!

Scalping Crypto With the Power Scalper: Long & Short Entries

Alright, you are now aware of the technical indicators you need to use the strategy. The next step is understanding when the strategy generates long (bullish) and short (bearish) signals.

Let’s first take a look at the conditions for a long signal.

Long Scalping Signal

- The RSI exceeds 70, signaling an overbought market.

- The closing price exceeds the SSL Up value, indicating bullish momentum.

- The Force Index Value is above 0.05, which indicates intense buying pressure.

Probably the most exciting aspect of signal generation is the usage of the RSI. Usually, overbought RSI signals are used to open short trades. However, it would be best to remember that the strategy is a crypto scalping strategy.

Short Scalping Signal

The signal to open a short trade is vice versa:

- The RSI drops below 30, signaling an oversold market.

- The closing price is less than the SSL Down value, indicating a bearish momentum.

- The Force Index value is below -0.05, reflecting an intense selling pressure.

Power Scalper Backtest Results

As always, the true measure of a strategy lies in its performance under rigorous testing. Our backtest analysis of the Power Scalper strategy closely examines how these indicators perform individually and in concert. Therefore, we tested the strategy across over 180 tokens and a set of historical data ranging from one to five years (depending on the token).

Moreover, we did all backtests based on the 15-minute chart, usually the preferred chart for scalping crypto tokens. So, let’s dive into the results.

Power Scalper Backtest: Long Signals

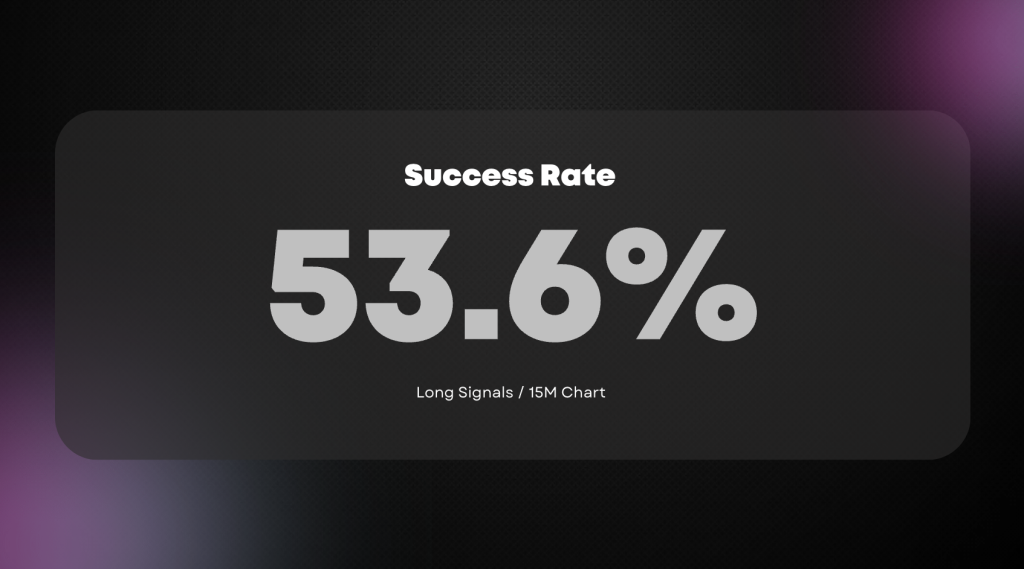

When our backtest algorithms presented the overall results for the Power Scalper strategy, it was somehow disillusioning. The strategy delivered a success rate of only 53.6%. Therefore, on average, the strategy did not perform better than educated guessing. However, we looked closer and examined the performance of different tokens — and the results were astonishing.

Top Performing Crypto Tokens — (Long Signal / 15-Minutes Chart)

Contrary to the average overall performance, we could find many crypto tokens showing extraordinary results. Here are some of the top-performing tokens:

| Crypto Token | # of Signals | Success Rate |

|---|---|---|

| Pundi X (NPXS) | 84 | 86.9% |

| Storm (STORM) | 23 | 73.9% |

| Osmosis (OSMO) | 522 | 69.4% |

| Firo (XZC) | 54 | 68.5% |

| aelf (ELF) | 807 | 66.8% |

| Tellor (TRB) | 691 | 66.7% |

| Injective Protocol (INJ) | 611 | 66.1% |

| Chainlink (LINK) | 678 | 65.9% |

Worst Performing Crypto Tokens — (Long Signal / 15-Minutes Chart)

Additionally, here are the tokens that performed poorly when scalped with the Power Scalper. One could even think about using the strategy as an inverse indicator 🙂

| Crypto Token | # of Signals | Success Rate |

|---|---|---|

| Decred (DCR) | 1103 | 40.8% |

| Spell Token (SPELL) | 374 | 40.6% |

| OAX (OAX) | 173 | 40.5% |

| Gifto (GTO) | 89 | 39.3% |

| AirSwap (AST) | 444 | 38.7% |

| Radworks (RAD) | 334 | 38.6% |

| Voyager Token (VGX) | 265 | 35.9% |

| Juventus Turin Token (JUV) | 193 | 35.8% |

Power Scalper Backtest: Short Signals

After dissecting the long signals, we wanted to see how the strategy works for short signals. However, although the results were slightly better, the strategy still did not convince us as the go-to strategy for all tokens. Overall, the strategy achieved a success rate of 56.4% for short signals on the 15-minute chart.

Top Performing Crypto Tokens — (Long Signal / 15-Minutes Chart)

Similar to the long signal, we took a more detailed look at the tokens’ performance. Here are the top performers.

| Crypto Token | # of Signals | Success Rate |

|---|---|---|

| Nano (NANO) | 12 | 83.3% |

| Loom Network (LOOM) | 323 | 73.7% |

| NanoByte Token (NBT) | 159 | 71.7% |

| Pepe (PEPE) | 228 | 71.5% |

| Neblio (NEBL) | 707 | 70.9% |

| Illuvium (ILV) | 20 | 70% |

| Internet Computer (ICP) | 502 | 69.3% |

| Osmosis (OSMO) | 670 | 69.1% |

Worst Performing Crypto Tokens — (Short Signal / 15-Minutes Chart)

| Crypto Token | # of Signals | Success Rate |

|---|---|---|

| Binance Coin (BNB) | 1684 | 46.9% |

| Neo (NEO) | 581 | 45.6% |

| Litecoin (LTC) | 593 | 45.5% |

| Radworks (RAD) | 489 | 45.2% |

| Bitcoin Cash (BCH) | 1734 | 44.5% |

| Ripple (XRP) | 453 | 44.4% |

| Tron (TRX) | 499 | 43.7% |

| Injective Protocol (INJ) | 386 | 37.6% |

Evaluating the Power Scalper Strategy for Crypto Scalping

A Critical Analysis: Is Power Scalper the Optimal Strategy for Scalping?

As we reach the culmination of our extensive analysis of the Power Scalper strategy, the central question looms: Is this the best strategy for scalping in the crypto market? The answer, as our data-rich exploration reveals, is nuanced.

The Power Scalper’s Performance: A Mixed Bag

Our backtesting journey uncovered a dichotomy in the Power Scalper strategy’s effectiveness. On one hand, the average success rate for long signals was a modest 53.6%, barely surpassing the threshold of educated guessing. Similarly, while slightly better at 56.4% for short signals, it still didn’t paint a picture of overwhelming success. At first glance, these figures might cast doubts on the strategy’s reliability as a one-size-fits-all solution for crypto scalping.

Token-Specific Success: A Strategy’s Redemption

However, delving deeper into specific tokens, we uncovered a different story. Certain tokens aligned exceptionally with the Power Scalper’s methodology, yielding higher success rates than the average. Tokens like NPXS, STORM, and OSMO in bullish scenarios and NANO, LOOM, and NBT in bearish contexts showcased the strategy’s potential when applied judiciously.

The Complexity of Scalping Cryptos on Low Timeframes

Acknowledging the inherent challenges of scalping on low timeframes like the 15-minute chart is imperative. Achieving a high success rate in such a rapidly changing environment is daunting, and the Power Scalper’s performance must be contextualized within this complexity.

Strategic Application: The Key to Success in Scalping Crypto Tokens

Based on our comprehensive analysis, the Power Scalper strategy, while not universally optimal, shines in its applicability to specific tokens. This selective approach could be the key to unlocking its potential. Traders might find it advantageous to apply this strategy to tokens that historically resonate with its parameters rather than employing it indiscriminately across the crypto market.

Conclusion: A Tool for the Discerning Scalper

In summary, the Power Scalper strategy emerges as a potent tool, not in a universal sense, but as a strategic weapon in the arsenal of discerning scalpers. Its effectiveness hinges on selective application and a deep understanding of each token’s behavior about the strategy’s indicators.

As we wrap up this analytical journey, it’s clear that while the Power Scalper might not be the quintessential strategy for every crypto scalper, it holds significant value for those willing to apply it with precision and insight. It stands as a testament to the principle that knowledge and strategic application are key to maximizing success in the world of crypto scalping.

About CryptoKnowledge

At CryptoKnowledge, we pride ourselves on providing top-notch crypto data and tools. Our app is accessible on both the App Store and Play Store, featuring an array of functionalities like crypto signals, screeners, AI-based forecasts, and much more. Discover how we can elevate your trading experience, and download the app now!