VET — Current Status: VeChain’s Sturdy Stand

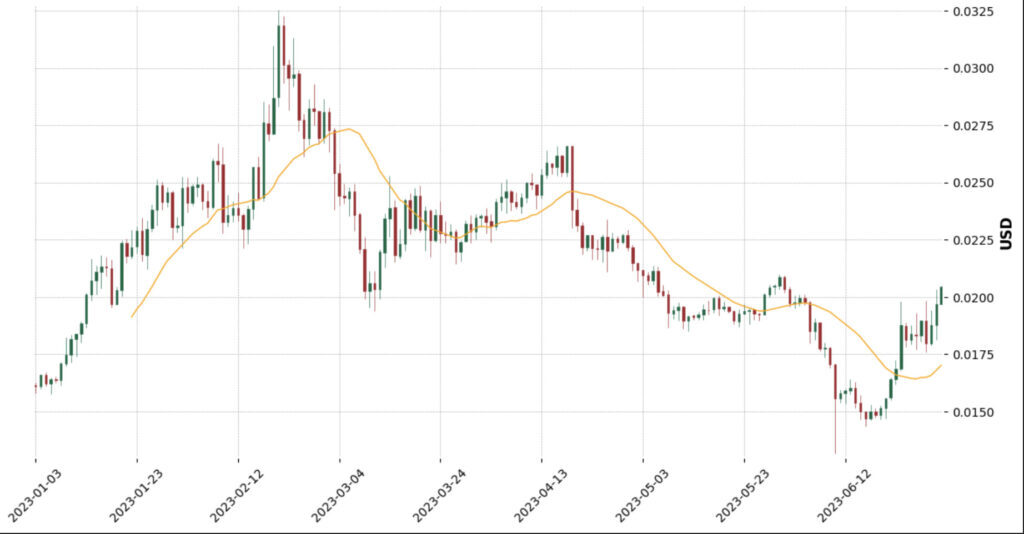

VeChain (VET), an underdog in the crypto universe that’s gradually gaining recognition, has seen a positive uptick recently. The token currently trades at a promising $0.021, showcasing a steady 2.85% surge in the last 24 hours.

As we dig deeper into the price patterns, we see that VeChain is approaching a resistance level of $0.0218. This pattern, though still in the process of forming, forecasts a potential bullish price movement toward the resistance in the near future. Investors are attentively observing these developments, anticipating the path that VET is likely to tread.

VeChain (VET) Technical Indicators

Diving into the heart of the technical analysis, let’s interpret what the indicators suggest about VET’s current stance and future possibilities:

- Trends based on moving average: The Short Term and Medium Term Simple Moving Averages (SMA) demonstrate an uptrend, indicating favorable conditions for buyers. However, the Long Term SMA depicts a downtrend, cautioning investors of potential future market volatility.

- RSI (Relative Strength Index): The RSI for VeChain is neutral but nearing the overbought threshold. This implies that the market shows high buying activity and may soon need a brief pause or a minor price adjustment.

- MACD (Moving Average Convergence Divergence): The MACD displays a bullish signal, indicating strong positive momentum. This suggests it might be an appropriate time for investors to consider opening long positions.

- Ultimate Oscillator: Echoing the MACD’s message, the Ultimate Oscillator also exhibits a bullish sign. This corroborates the perception of current market dominance by buyers.

- ADX (Average Directional Index): The strong reading from the ADX means that the present trend, whether it’s bullish or bearish, is gaining momentum and is worth keeping an eye on.

VeChain (VET) — Trade Setup & Outlook

Judging from the technical indicators, VeChain (VET) is experiencing a short-term uptrend. With bullish signs from the MACD and the Ultimate Oscillator, the momentum favors the buyers, suggesting that it could be an opportune time for investors to consider entering the market.

However, with the RSI approaching the overbought zone, it would be wise for investors to brace for potential price adjustments. A minor pullback could provide an ideal entry point for new or additional positions.

Furthermore, the ADX’s strong reading implies that the current trend is robust, further reinforcing the optimistic short-term outlook. As always, investors are encouraged to use stop-loss orders as a safety net against any unexpected market fluctuations.

Summary: VET’s Momentum and Market Outlook

VeChain (VET) is witnessing a good short-term uptrend, with several technical indicators reinforcing a positive outlook. However, caution is advised due to the RSI nearing the overbought zone, hinting at possible price adjustments.

VeChain, with its unique proposition in the blockchain space, offers a potentially lucrative opportunity for crypto enthusiasts. As always, while the short-term outlook for VET looks promising, investors should closely monitor the market dynamics and make informed decisions.

About VeChain (VET): A Glimpse into VeChain’s World

VeChain (VET) is a blockchain-based platform that enhances supply chain management processes. By utilizing tamper-proof distributed ledger technology, VeChain allows retailers and consumers to determine the authenticity and quality of products bought. VeChain’s native token, VET, is used to run smart contracts on the VeChainThor blockchain.