Since the inception of my crypto trading journey in 2017, I’ve navigated through the tumultuous waves of the cryptocurrency markets.

Initially, I, like many others, was smitten by the allure of complexity, convinced that it held the keys to my trading success. I was in pursuit of the ‘holy grail’ of trading strategies, with a firm belief that complexity equaled sophistication and, consequently, profitability.

In the initial years, I spent considerable time, effort, and resources attempting to unravel and employ many complex trading strategies. Every strategy promised the moon, and I embarked on each one with enthusiasm that was quickly replaced by disenchantment. As I delved deeper into the intricacies of these strategies, my trading ledger painted a picture that was starkly different from what I had envisioned. During this exploration, I discovered that successful trading depends on patience and consistency rather than the most complex strategy.

The Shift Towards Simplicity

As I became more entrenched in the trading world, my experiences shaped a different perspective. The promise of quick riches and instant success through sophisticated trading strategies began to fade, replaced by the realization that these ‘get-rich-quick’ schemes were nothing more than mirages. My relentless quest for the complex was gradually replaced by an appreciation for the basic and straightforward.

I found myself focusing more on proven technical indicators such as the Moving Average Convergence Divergence (MACD), Exponential Moving Average (EMA), and Relative Strength Index (RSI). The balance began to shift in my trading approach when I observed that these basic indicators, combined with patience and consistency, often outperformed the convoluted algorithms I had previously relied upon.

We analyze over 100 cryptocurrencies and send out MACD, RSI & EMA trade alerts.

The 30% Profit Story – A Simple Trading Strategy at Work

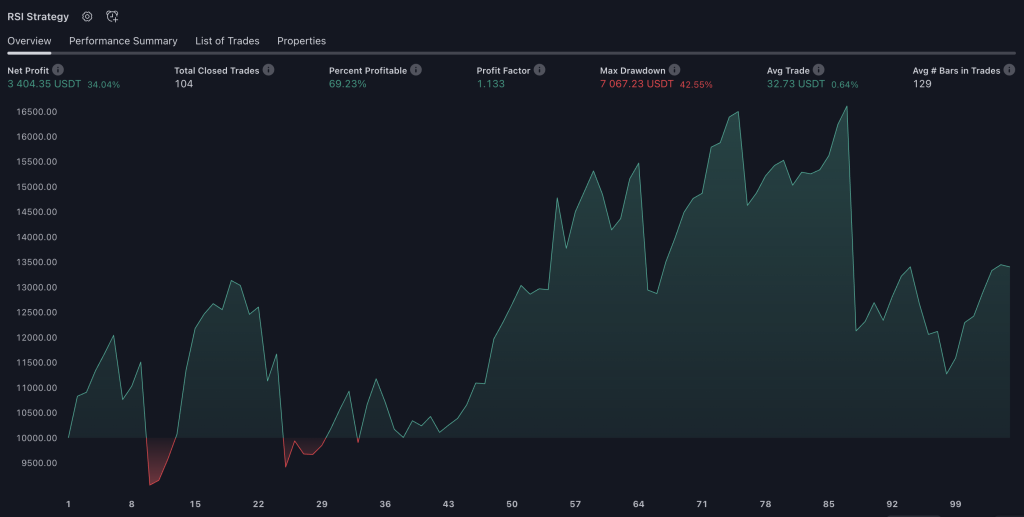

Now, allow me to walk you through a practical, real-world application of a simple strategy. Let’s travel back to April 1st when I embarked on a 100-day journey trading Ripple’s XRP, guided solely by the RSI indicator. The RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements.

In this strategy, I adopted a simple rule. I would go short whenever the RSI signaled that XRP was overbought, suggesting that it would likely experience a price correction. Conversely, I would go long when the RSI indicated that the asset was oversold, hinting at a possible price rebound.

This might sound overly simplistic, and one might question the wisdom of relying solely on a single indicator. However, the results were pleasantly surprising. Over the 100-day period, I accumulated a net profit of almost 35%. Comparatively, a straightforward buy-and-hold strategy would have resulted in a substantial 45% loss during the same period.

Notably, about 70% of my trades were profitable. This basic yet strategic approach significantly outperformed a standard buy-and-hold approach in a predominantly bearish market.

The Power of Simplicity – An Analysis

At this point, it’s crucial to note that while the RSI performed well in this instance, combining it with other indicators like the MACD or EMA could potentially yield even better results. It’s all about creating a balanced approach that considers various market conditions.

As you might see, the Max Drawdown is quite high. Accordingly, I would advise going for this over-simplistic strategy but always combining the strategy with other indicators like the MACD or EMA to avoid huge drawdowns.

However, the primary intention of sharing this example was to illustrate the potential of a straightforward strategy. Often, we get so caught up in the quest for the ‘perfect’ strategy that we overlook the value of simplicity. Complexity can sometimes become a roadblock, clouding our judgment and distracting us from the primary objective: understanding and responding to market dynamics.

Conclusion: Embracing the Simplicity in Trading

In conclusion, successful trading is not about employing an arsenal of advanced, complicated strategies. Rather, it’s about having a clear vision, showing patience, maintaining consistency, and having a well-defined yet straightforward trading strategy.

In my journey, embracing simplicity in my trading strategy helped me achieve a 30% profit in a mere 100 days. As you venture further into crypto trading, remember that simplicity can be your best guide. Harness the power of simplicity, and you may find yourself navigating the stormy seas of the cryptocurrency market with greater ease and success.

Ultimately, the key to successful trading lies not in deciphering complexity but in harnessing simplicity. Remember, complexity can often be a hindrance, while simplicity can often be a catalyst for understanding and, ultimately, for success.