September heralds fresh opportunities and shifts in the crypto market. In this special analysis, we spotlighted TRON (TRX), a cryptocurrency showing bullish signs amidst a generally bear market. Here, we break down the data and provide simple yet professional insights into TRX’s market position and potential moves in the coming month.

Check out our latest article about Ethereum and Bitcoin

→ Ethereum’s September Analysis: Key Insights and Trade Recommendations

→ Bitcoin Price Update: Your Week-Ahead Outlook Unpacked!

TRON Analysis — Current Status Overview

TRON (TRX) is trading at $0.079, showcasing a slight uptick in the last 24 hours with an increase of 0.938%.

Before diving into the technical indicator details and other parts of our TRON analysis, looking at TRON’s price chart is essential. As you can easily identify below, TRON has been in a wonderful upward channel since the end of 2022. Despite some dips and the overall bear market, TRON managed to grow nicely.

Here are some more details about TRON’s latest price action:

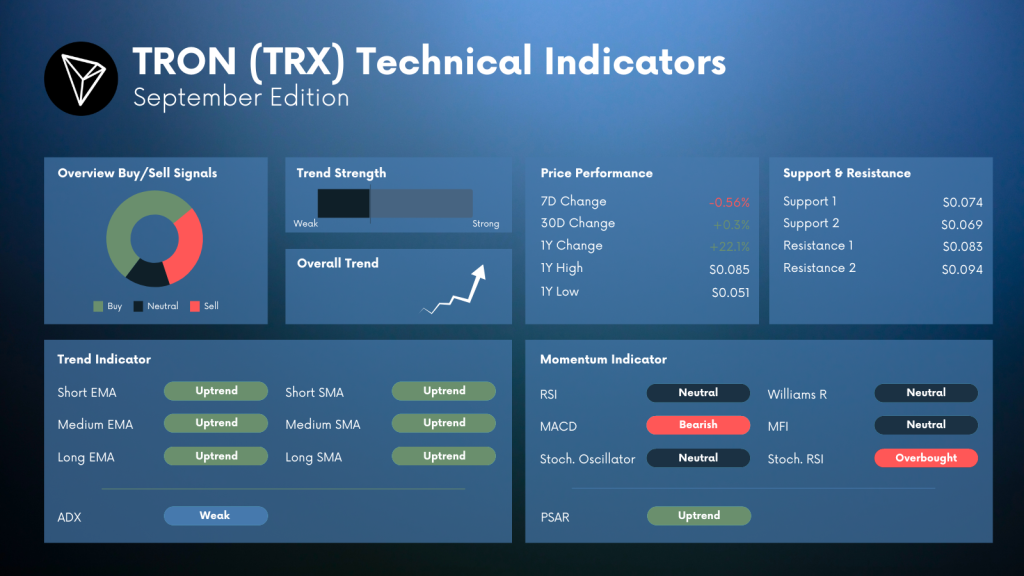

- Despite a minuscule dip of 0.56% over the last week, the coin has maintained a slight growth over the month, at 0.3%.

- The yearly overview portrays a positive image with a 22.06% increase, peaking at $0.0851 and plummeting to a low of $0.0501.

TRON Trend Analysis – A Positive Surge Amidst a Sluggish Season

TRON’s market trend is currently on a noticeable uptrend, indicated by both the short-, medium, and long-term EMA and SMA.

Although the ADX shows a weak trend strength, the overall market trend for TRX is notably bullish, a rare occurrence in the current market climate.

Momentum Indicators – Gauging the Momentum

The analysis of TRON’s momentum indicators shows some mixed signals. However, the bullish signs seem to be dominant. But let’s take it step-by-step.

TRX displays a neutral standing across multiple indicators such as RSI, Stochastic Oscillator, Williams R, and MFI in the momentum sector.

The MACD hints at a bearish trend, yet the Stochastic RSI indicates an overbought market, potentially hinting at a temporary price correction soon.

Despite the mixed signals, the overall momentum seems to lean slightly towards a bullish tendency.

More about TRON (TRX)

→ AI’s Bold Prediction for Tron’s (TRX) Price by the End of 2023

→ Tron (TRX): Rising Against The Tide – A Comprehensive Analysis of TRX’s Resilience Amidst Market Correction

→ Tron (TRX): A Beacon in the Storm – How To Trade

Short-Term & Long-Term Trade Recommendation – Bullish Bets in the Offing?

Considering the largely bullish indicators, investors might find opportunities for both short and long-term investments. The notable uptrend signals suggest that trading within the established support ($0.074 and $0.069) and resistance levels ($0.083 and $0.094) might present profitable opportunities, particularly for traders with a bullish outlook.

TRON Analysis: Prospective Bullish Outing for September?

In a nutshell, based on our analysis, TRON appears to be carving a bullish path, showcasing resilience and potential for growth in September. The prevailing market conditions hint at opportunities for positive trades, especially for those looking to leverage the bullish indicators seen in TRX’s current market dynamics.

About TRON – TRX’s Journey in the Crypto Sphere

TRON, known in the market as TRX, has consistently positioned itself as a prominent player in the cryptocurrency landscape. Established with the vision of decentralizing the internet, TRON facilitates the creation and execution of smart contracts and decentralized applications, free from middlemen and censorship. Despite a mixed bag of market indicators, TRX stands out as a potential growth beacon in the present market scenario, promising exciting prospects for the month ahead.

Your Next Step(s)

→ Check out the CryptoKnowledge Platform and enhance your trading skills

→ Start trading TRON